What Car Company Car Tax

The internal revenue service counts fringe benefits goods services and experiences given to employees in addition to standard wages as a form of taxable income.

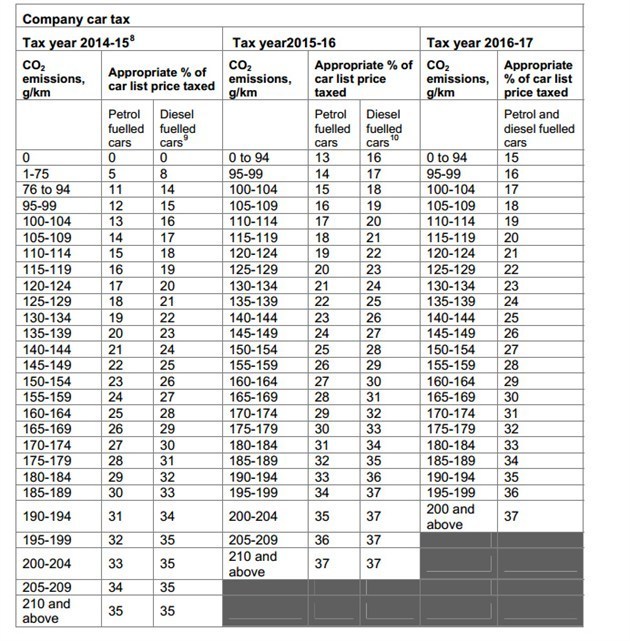

What car company car tax. In most cases time spent using your company car for personal use is considered a taxable fringe benefit. Need helping working out your company car tax. Rates may go up or down over different tax years. Finance department tax collection division.

The parkers company car tax calculator helps you work out how much benefit in kind tax you would have to pay for your new company car broken down into annual and monthly costs for 20 40 or 45 percent tax payers. What will the company car tax be on a. Send tax collector questions or comments click here. Curiously the government plans to hike up bik tax for electric cars and hybrids in 201920.

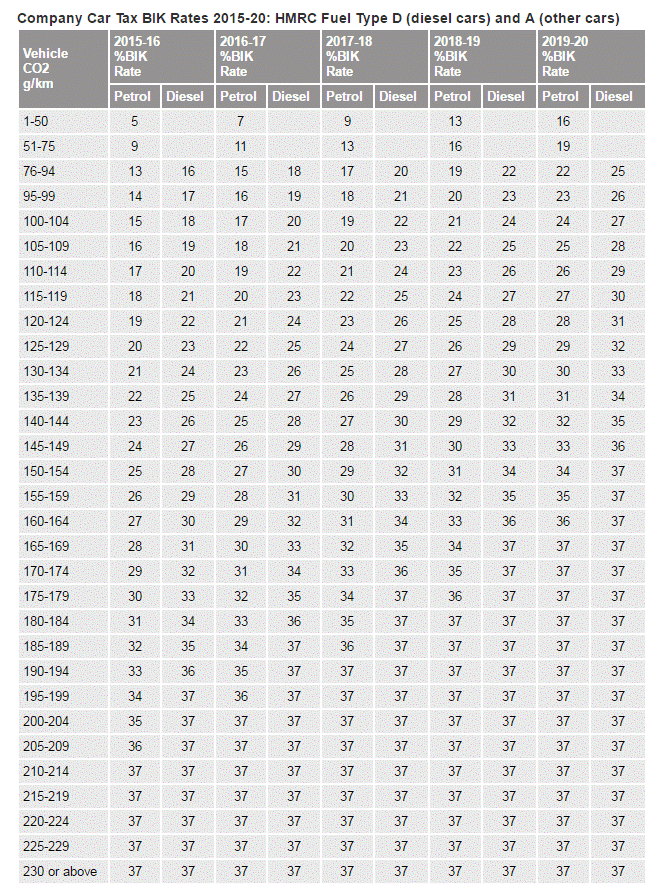

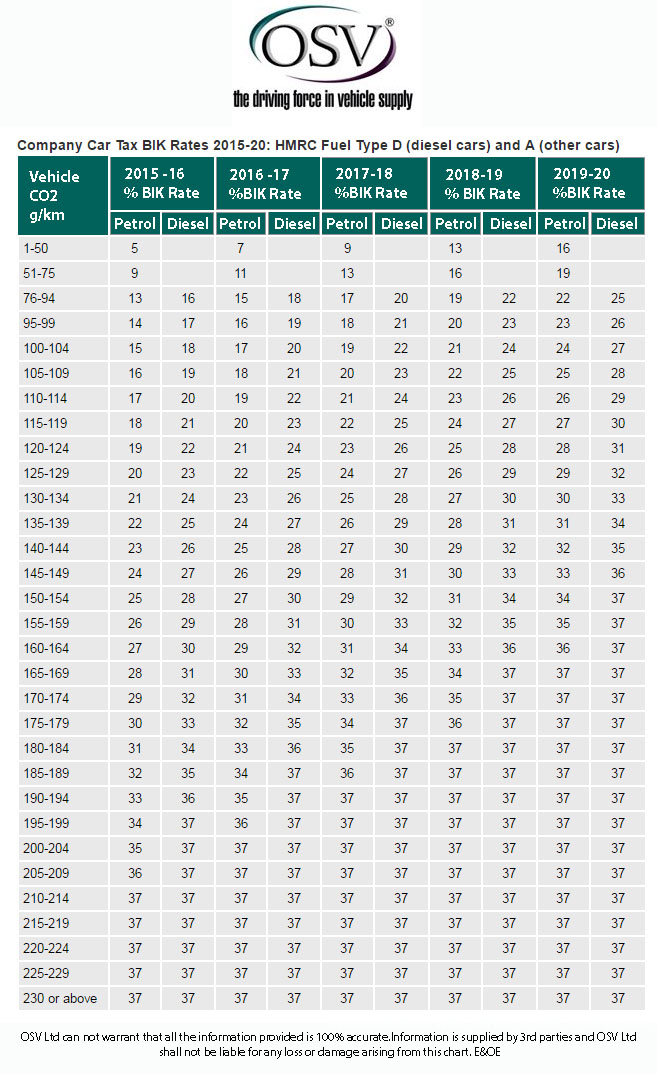

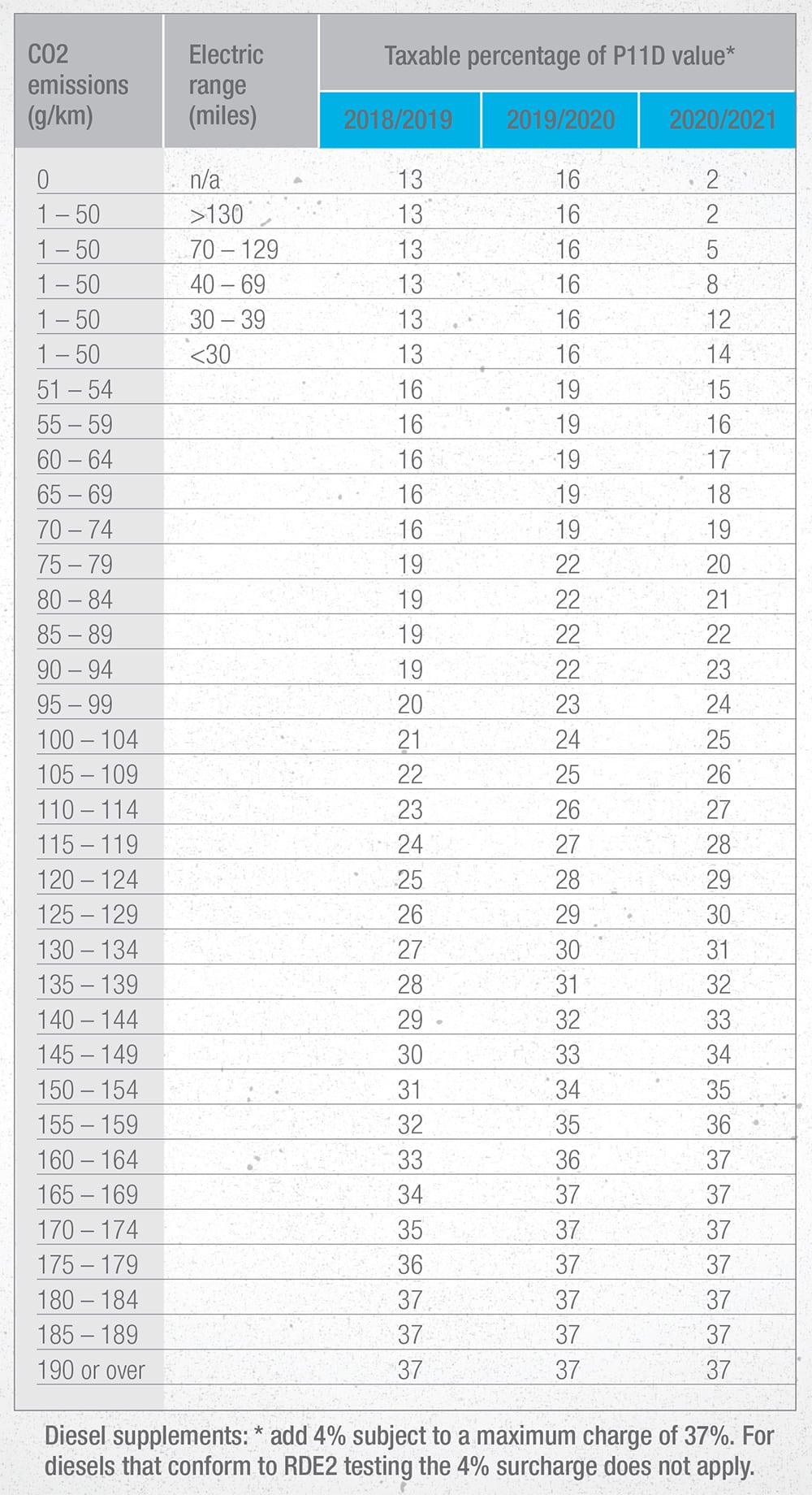

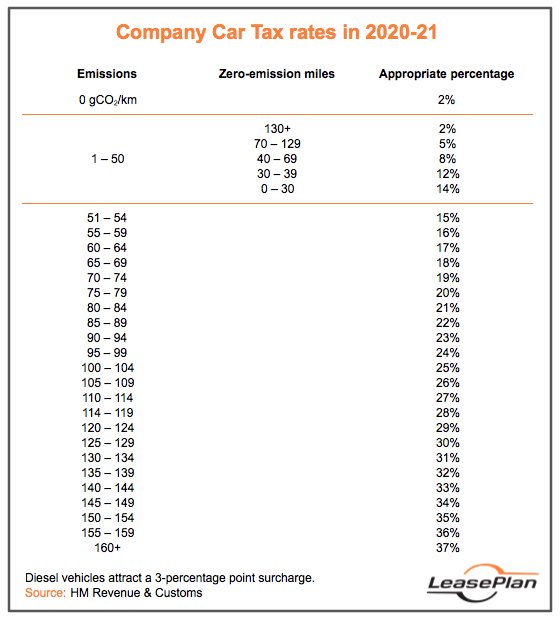

Offices closed between 1230pm 130pm daily. But itll slash it to two percent as from 202021. Cars with lower emissions incur lower levels of tax. The amount you have to pay in tax will also depend on which tax bracket you are in as you will either be taxed 20 or 40.

To calculate your company car tax you do the following. Click for directions to municipal building. Multiply your benefit in kind amount by your personal tax rate. Benefit in kind tax on company cars is based on carbon dioxide emissions and the list price.

Company car tax is designed to encourage business drivers to choose cars with lower co2 emissions so the amount payable rises on a sliding scale in line with emissions. Irs taxable fringe benefits for a company car. This value of the car is reduced if. Tax on company cars.

Different rules apply according to the type of fuel used. And how much co2 your car emits also plays a big part in it. You pay something towards its cost. Company car tax calculator.

Company car tax calculator. This company car tax is called benefit in kind bik tax as the cars are seen as an additional taxable benefit that falls outside of your standard national insurance tax contributions. You can reach the tax collector. If youre struggling to decide which company car to go.

Choose the car using the form below. Youll pay tax if you or your family use a company car privately including for commuting. This means that in 202021 company car tax on electric cars and hybrids will be significantly cheaper than a tax on company cars with other engine types. With company cars the bill is a percentage of their cars p11d value calculated according to its co2 output.