What Is Excise Duty Uk

Excise duty in business english.

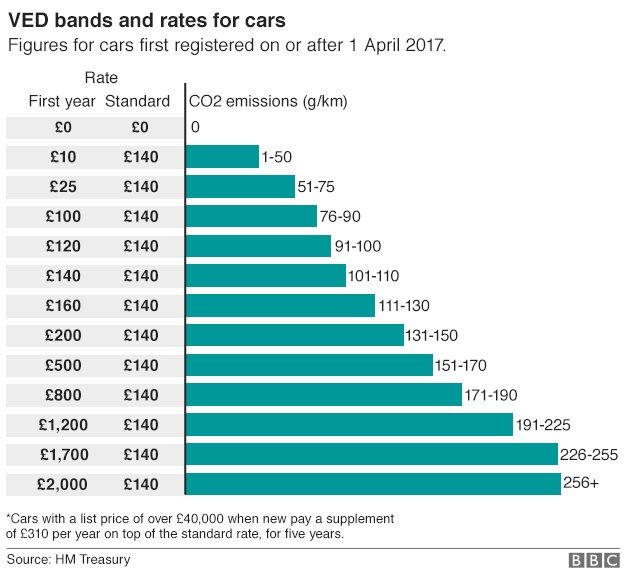

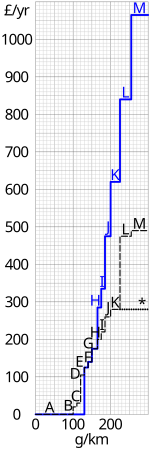

What is excise duty uk. Excise tax on the other hand is a flat tax applied before the purchase price for specific items some of them by states and some by the federal government. Smoking and drinking are two of them. Motorists can save about two thirds of the vehicle excise duty by choosing a cleaner car. Vehicle excise duty or ved is also referred to as vehicle tax car tax or road tax.

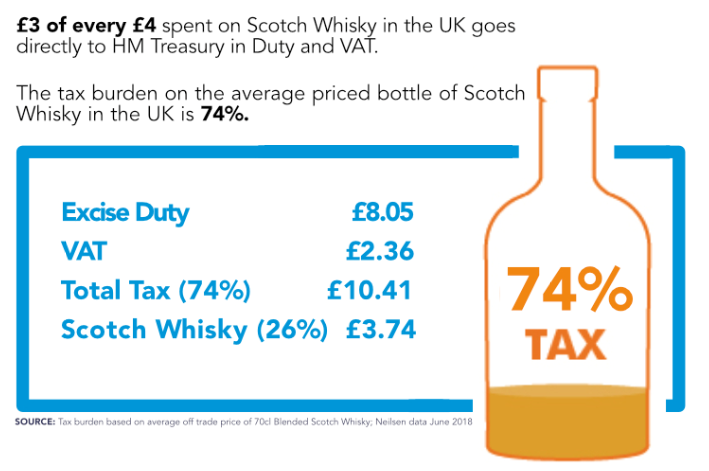

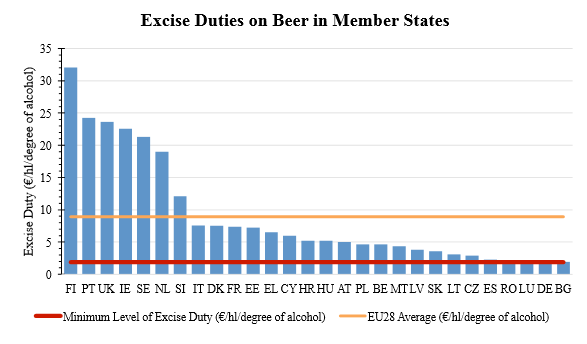

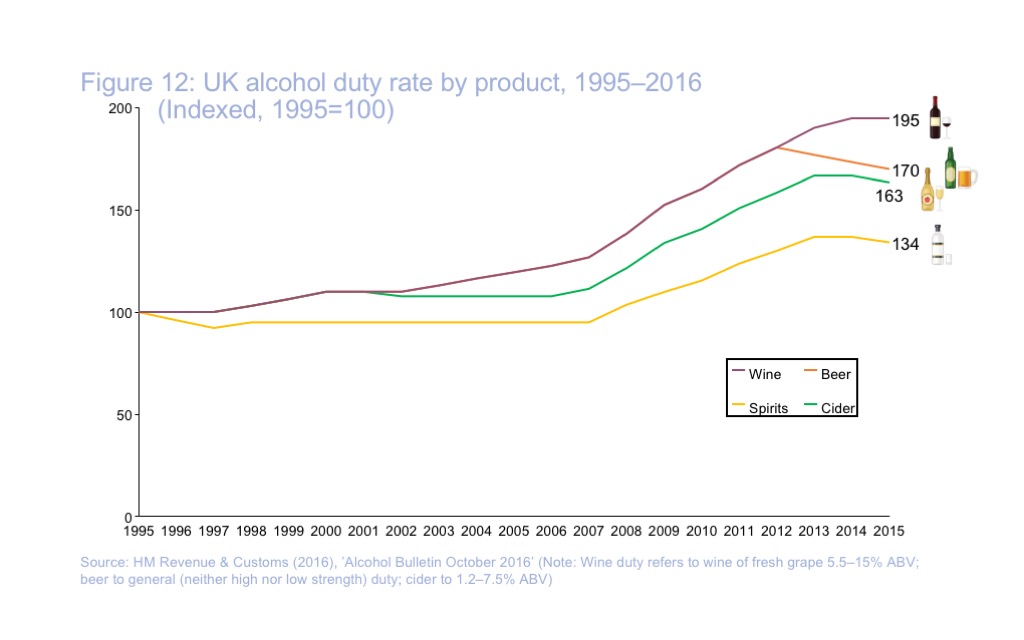

Excise duty what is excise duty. Excise duty is a tax that is designed to discourage the purchase of particular goods. So called undesirable social activities are subject to uk excise duties. How does us excise tax compare.

The tax type codes and excise duty rates to be applied are the same as for the type of mineral oil which the product is intended to substitute for or is to be added to. Find out more about different kinds of import duty. Excises are often associated with customs duties. An excise or excise tax is any duty on manufactured goods which is levied at the moment of manufacture rather than at sale.

Most vehicles used or parked on public roads in the uk will be subject to ved. Uk government levy an excise tax sin tax on some goods rated harmful to society. A tax on some types of goods such as alcohol cigarettes or petrol paid to a national or state government. The united states collects about 4 of its revenue from excise taxes lower than the 12 average of the other 29 nations in the oecd.

Although sometimes referred to as a tax excise is specifically a duty. This guide lists the current duty rates for two of the most popular tax on alcohol and tobacco. Customs are levied on goods which come into existence as taxable items at the border while excise is levied on goods which came into existence inland. Its collected and enforced by the dvla and if you arent using your vehicle you must make a sorn or statutory off road notification to take it off the road.

Excise duty is an indirect tax. Spending on the program will be paid for by raising the federal excise tax on tobacco. Tax is technically a levy on an individual while duty is a levy on particular goods.