Vehicle Excise Duty Changes 2017

The government is set to introduce a huge shake up of the rules and regulations concerning vehicle excise duty ved on april 1 2017.

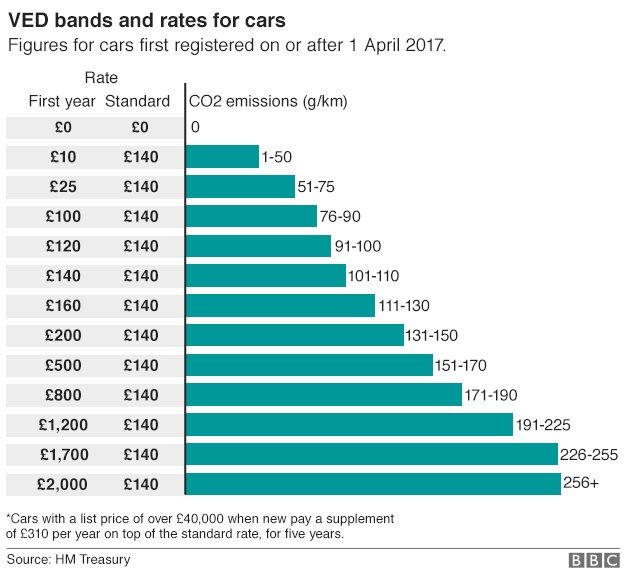

Vehicle excise duty changes 2017. Years of experience enquire today. Silverstone fleet management contract hire business and personal lease available across thousands of cheap vehicles bmw mercedes audi vw at low prices. The change doesnt affect any vehicle registered before 1 april 2017 but drivers can check the vehicle tax rates to make sure they know what they need to pay. Similarly something like a new diesel honda cr v with a list price of 27570 and co2 emissions of 139 gkm will pay 200 in its first year but just 140 a year thereafter.

The most polluting cars will pay 375 less compared to this years rates. This tax information and impact note affects purchasers of brand new cars from 1 april 2017 onwards. This measure reforms vehicle excise duty ved for cars registered from 1 april 2017 onwards. By contrast a car with zero emissions such as a tesla model s will continue to pay no road tax to start with.

Vehicle excise duty to change from 2017. Vehicle tax for the first year is based on co2 emissions. First year rates of ved will vary according to the carbon dioxide co2 emissions of the vehicle. The way vehicle tax is calculated has changed for cars and some motor homes that were first registered with dvla from 1 april 2017.

Changes to vehicle excise duty in 2017 mean motorists who choose to drive gas guzzlers and who currently pay up to 500 per year will save over 350 per year on the charge which is commonly referred to as road tax. Changes to the way ved vehicle excise duty or road tax is calculated will be changing for certain vehicles that are registered on or after 1st april 2017.