Vat On Diesel

Petrol diesel prices dip for the fifth straight day.

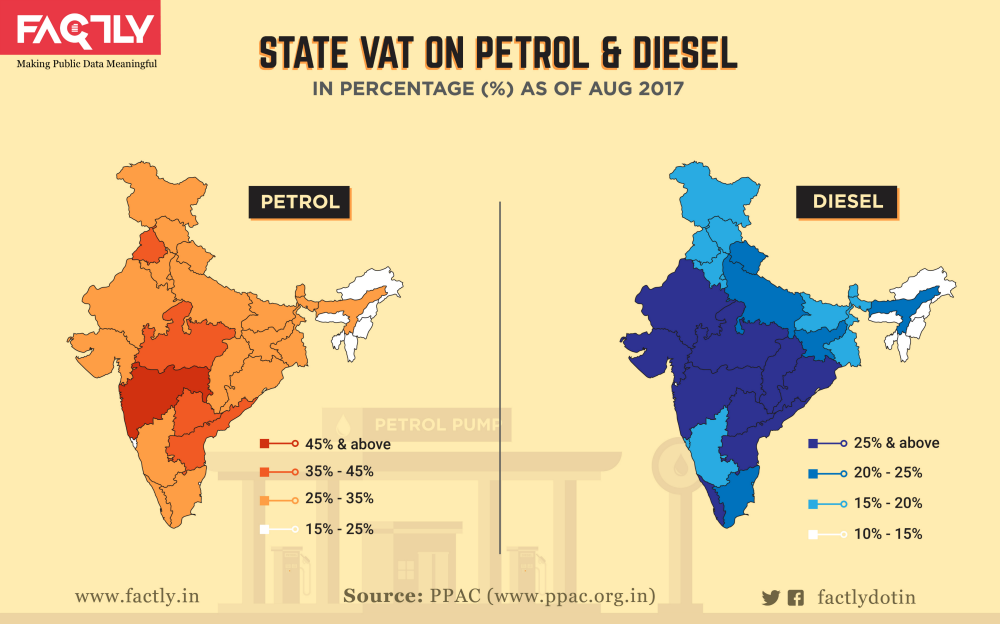

Vat on diesel. Fuel duty is included in the price you pay for petrol diesel and other fuels used in vehicles or for heating. It is built into the cost of many commonly consumed items such as clothing and petrol so you dont see what percentage of vat you are paying. The rate you pay depends on the type of fuel. The state vat on diesel is more than 20 in 12 states and highest of 2847 in andhra pradesh.

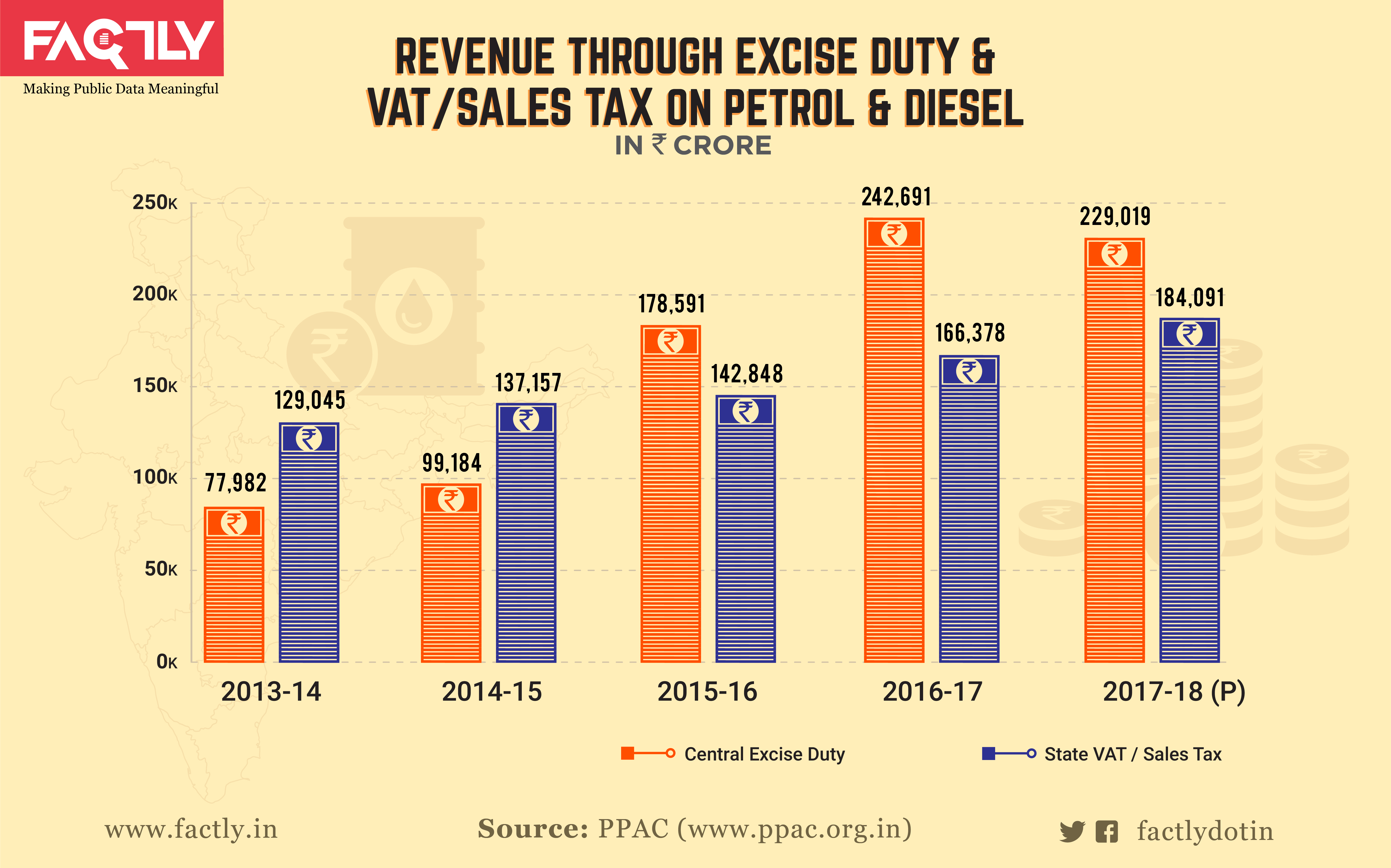

The central government revenue through excise duty on petrol diesel more than tripled between 2013 14 and 2016 17. You also pay standard rate vat at 20 on most fuel or the reduced rate of 5 on domestic heating fuel. The state vat on petrol is at least 25 in 20 states with the highest in mumbai at 3978. Claiming back vat on fuel is complex to work out and hard to gather the appropriate evidence and ensure you meet hmrc requirements.

63 fuel for use on foreign going ships and aircraft fuel supplied for use in a foreign going ship or aircraft is zero rated. Petrol diesel prices on the rise again. How can i reclaim vat. You pay different rates on other types of fuel depending on how theyre used.

Vat is due on the total value including any excise duty. The rates were reduced by a. And one of the trickiest areas our customers are often looking for help and advice is vat on mileage claims. The vat treatment indicated in the vat rates database is based on current practice and is updated regularly.

Oil companies cut petrol diesel prices. The delhi government is contemplating to reduce value added tax vat on diesel from 18 per cent to 166 per cent due to which the price of diesel may come down by around 60 paisa per litre. In bjp ruled states the reduction was higher as they. The value added tax vat rates database provides an extensive list of products and services which can be browsed navigated via the a to z links or searched using the search box.