Tax Road Uk Check Price

Depending when a car was registered the basis on which its road tax is worked out can fall under one of three different systems.

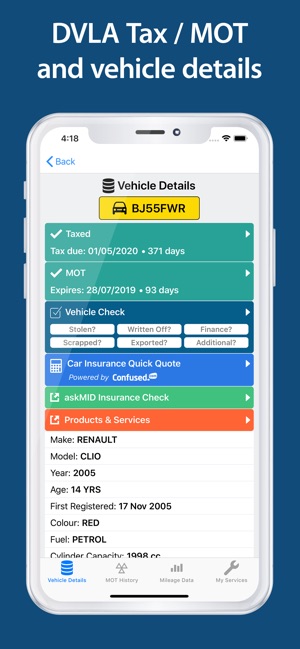

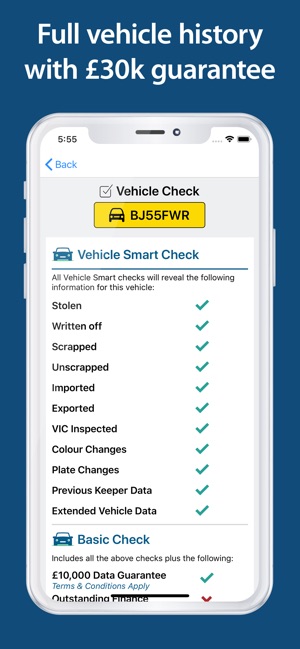

Tax road uk check price. Do i need car tax. Ved tax bands are then based on the fuel type that the vehicle uses with an additional rate of 310 per year. Road tax rules change once more after the first 12 months. Free car check enter your registration number number plate below to make a free vehicle enquiry.

It is mandatory for the vast majority of cars although some might be exempt. All cars in the uk pay annual car tax or vehicle excise duty ved. It was originally intended that all revenue raised from road tax would pay for the upkeep of uk roads. Car tax is a regular payment you make to the government so that you can drive your car on the road.

The display of tax discs on vehicles in the united kingdom all started back in 1921 with the implementation of the roads and finance act 1920. That sounds pretty good to us and even better news is the terrific choice of cars in that band from the practical to the premium. Includes road tax and mot check performance data registration details and technical specifications. In this case you would pay the ved tax rate based on the vehicle co2 emissions.

Car vehicle tax rates are based on either engine size or fuel type and co2 emissions depending on when the vehicle was. Even if the diesel engine emits the same or less emissions as its petrol alternative. The volkswagen golf gtd diesel hatchback emits 125gkm of co2 and registering that car after the 1st april 2018 will cost 205. There are thirteen co2 tax bands which relate to different emissions levels and amounts of car tax payable.

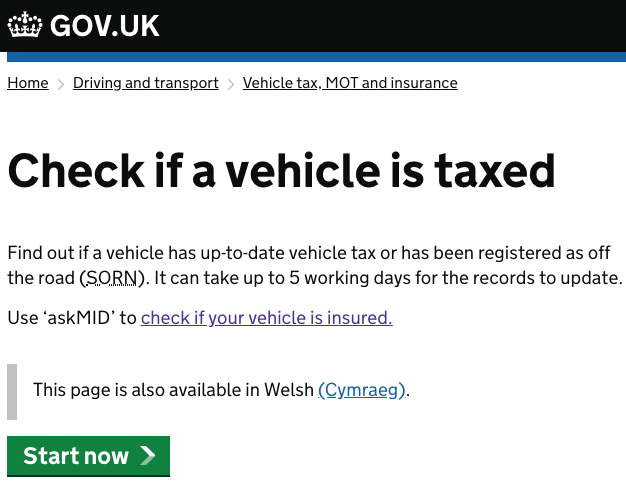

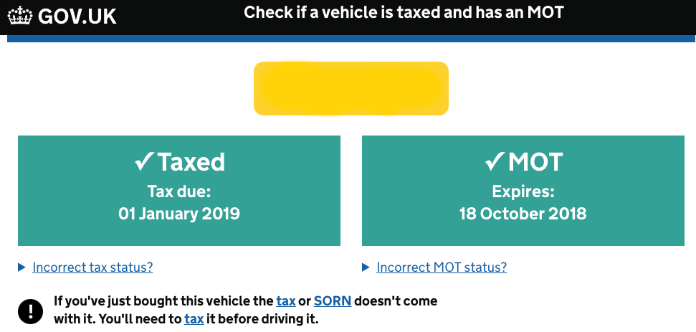

Check if a vehicle is taxed find out if a vehicle has up to date vehicle tax or has been registered as off the road sorn. It can take up to 5 working days for the records to update. Only two types of car are exempt from being. Owning a diesel will cost you more in road tax from 20182019 than it will for a petrol engine.

Fuel type and the cars new list price if over 40000 determine the rate paid. You can pay annually biannually or monthly. Even if you cant manage to be completely road tax free step up into ved band b for cars emitting 101 110 gkm of co2 and youll still only pay 25 per year. Calculate vehicle tax rates find out the tax rate for all vehicle types.

The list price influences whether the buyer needs to pay the standard rate or premium rate with those vehicles with a list of 40000 or more paying the latter for years two to six.