New Road Tax 2017

Do i need car tax.

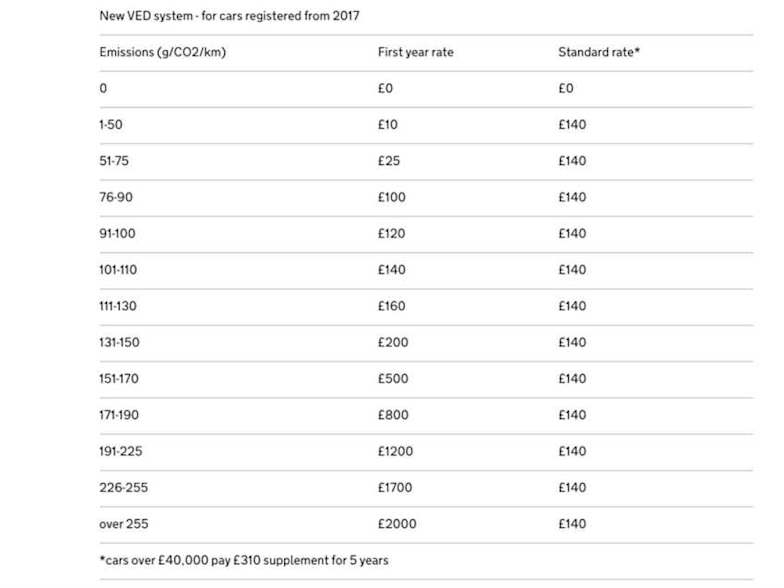

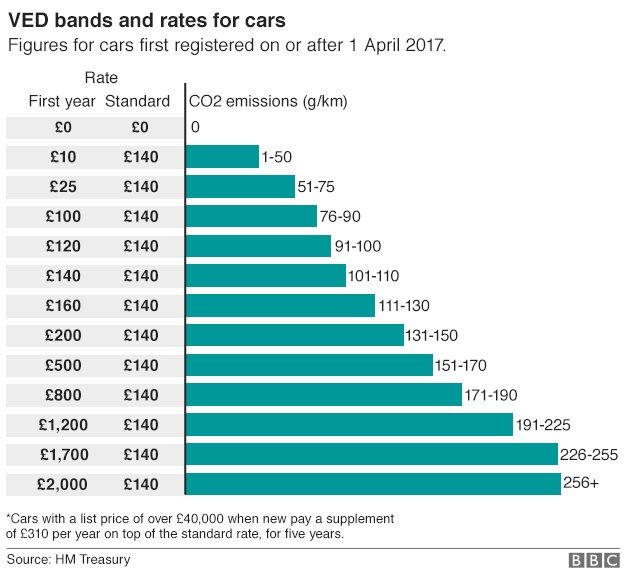

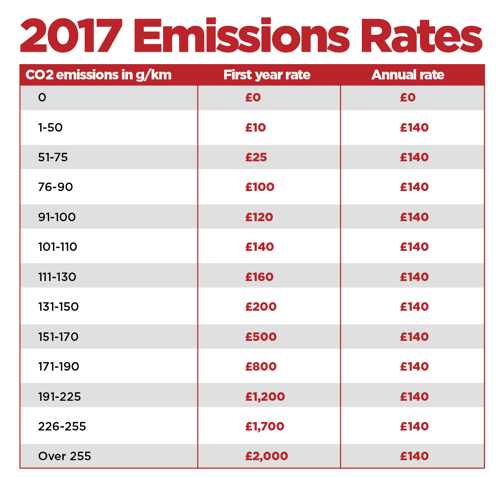

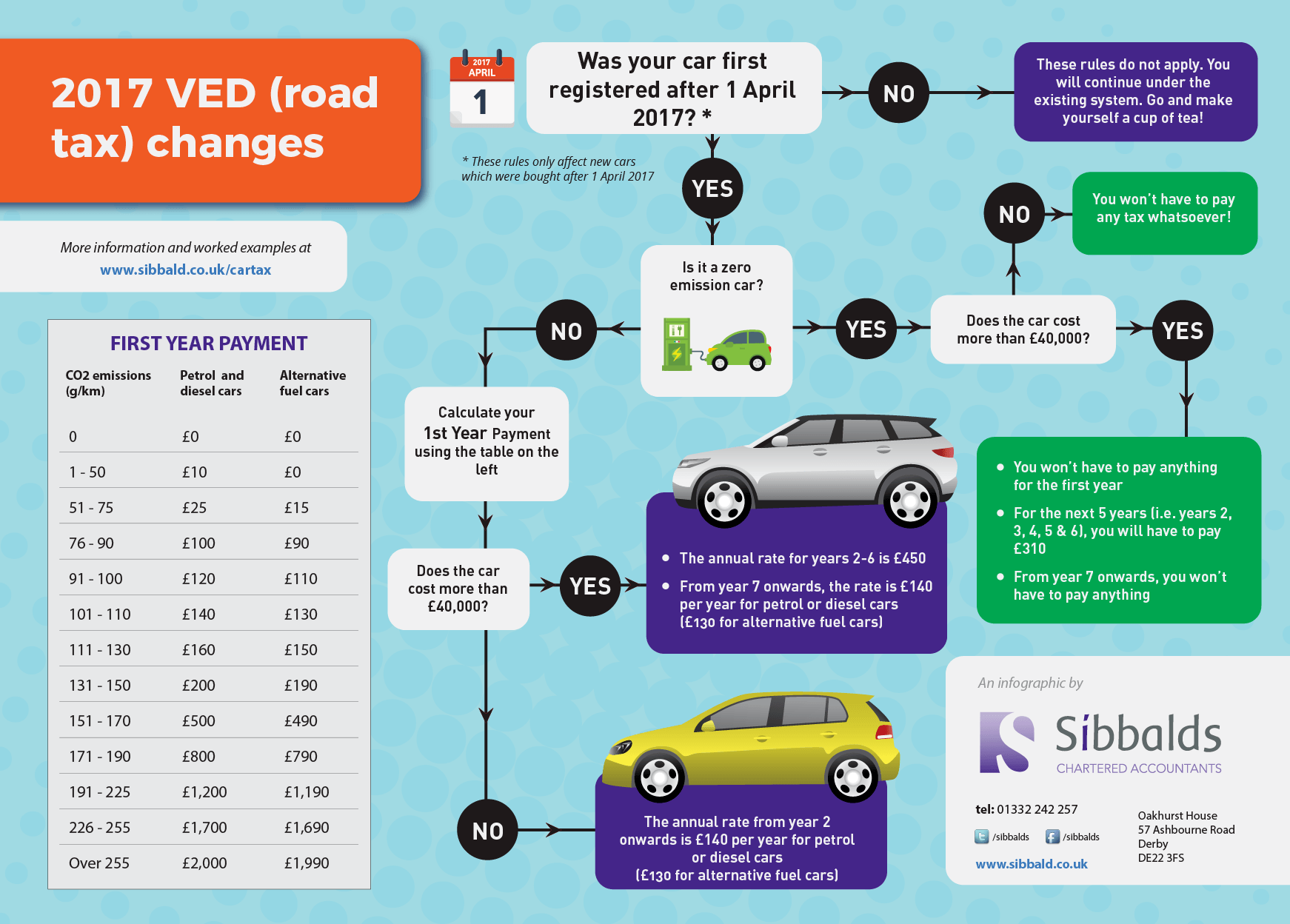

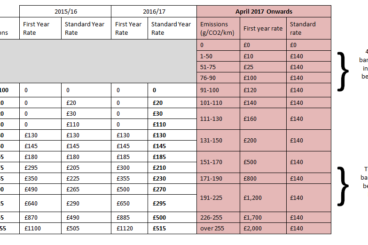

New road tax 2017. New 2017 road tax rules. A five minute guide from 1 april 2017 vehicle excise duty commonly known as road tax is set for some major changes. When the most recent road tax changes took place on 1 april 2017 all cars registered in the previous way had their tax frozen at the following rates. Only two types of car are exempt from being.

Check in our table below which category your car falls into. In short the dirtier your car the more your car tax will be for year one. Is it the best way to do it or is the government looking after its own again. If you are buying a brand new car in 2019 you will see the first year road tax cost on the invoice.

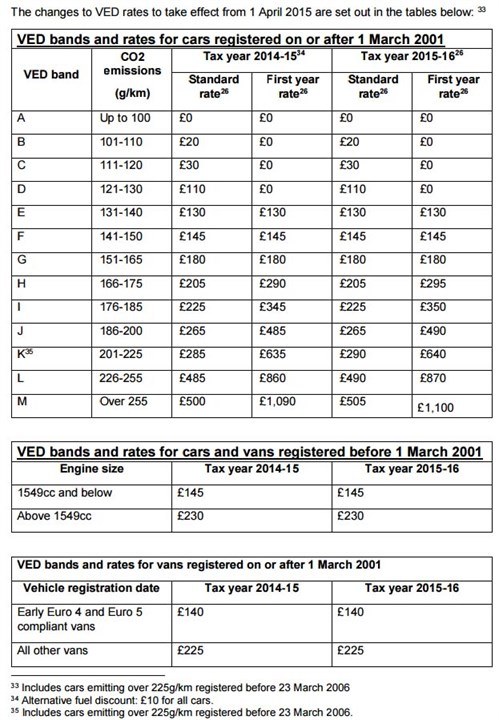

Car tax is a regular payment you make to the government so that you can drive your car on the road. Below is the ved band road tax rates for used cars registered after 1st march 2001 and before 1st april 2017. It is mandatory for the vast majority of cars although some might be exempt. The last major set of road tax changes in april 2017 saw a fixed rate of road tax applied to cars after their first year of registration and these new ved rates are not retrospective so cant be.

The rates below apply to any new car registered since 1 april 2017. You can pay annually biannually or monthly. Published on jan 11 2017 my take on the new ved tax system starting 1st april 2017. New vehicle tax rates from 1 april 2017 the change doesnt affect any vehicle registered before 1 april 2017 but drivers can check the vehicle tax rates to make sure they know what they need to pay.