Need To Tax My Car

Some less obvious than others including income tax liability.

Need to tax my car. Car tax is due regardless of whether your car is being driven regularly or parked up unused on a public road. Tax your car motorcycle or other vehicle using a reference number from. Its even more of a chore if youre a small business owner or a multicar family and have to do it for several vehicles. If taxing a vehicle registered to a northern ireland address you will need to show a valid vehicle insurance certificate or cover note.

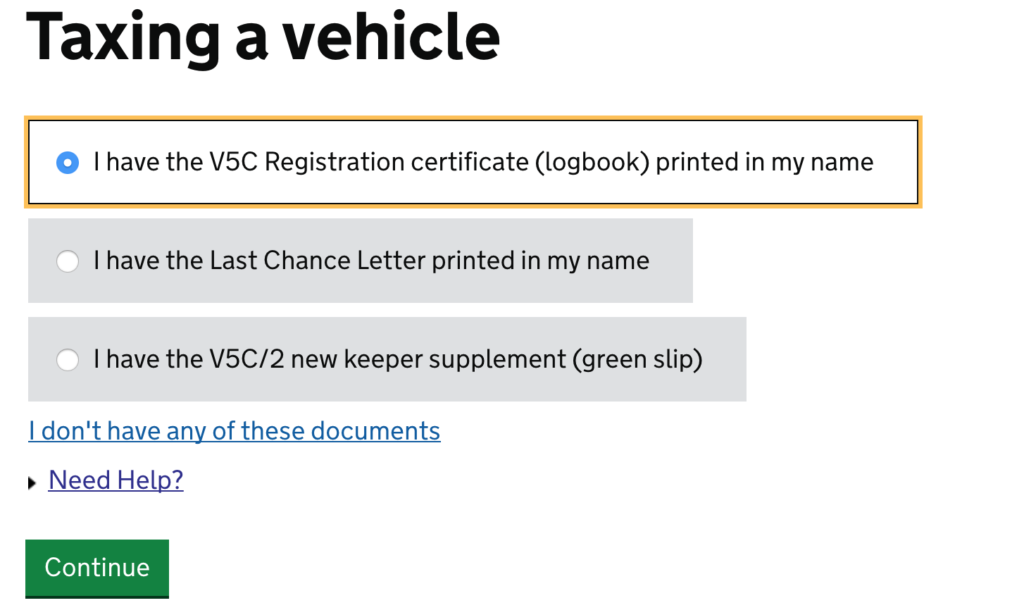

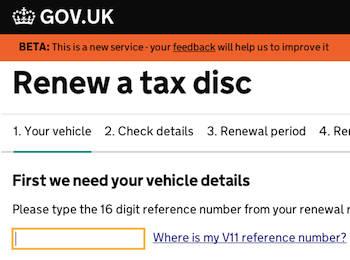

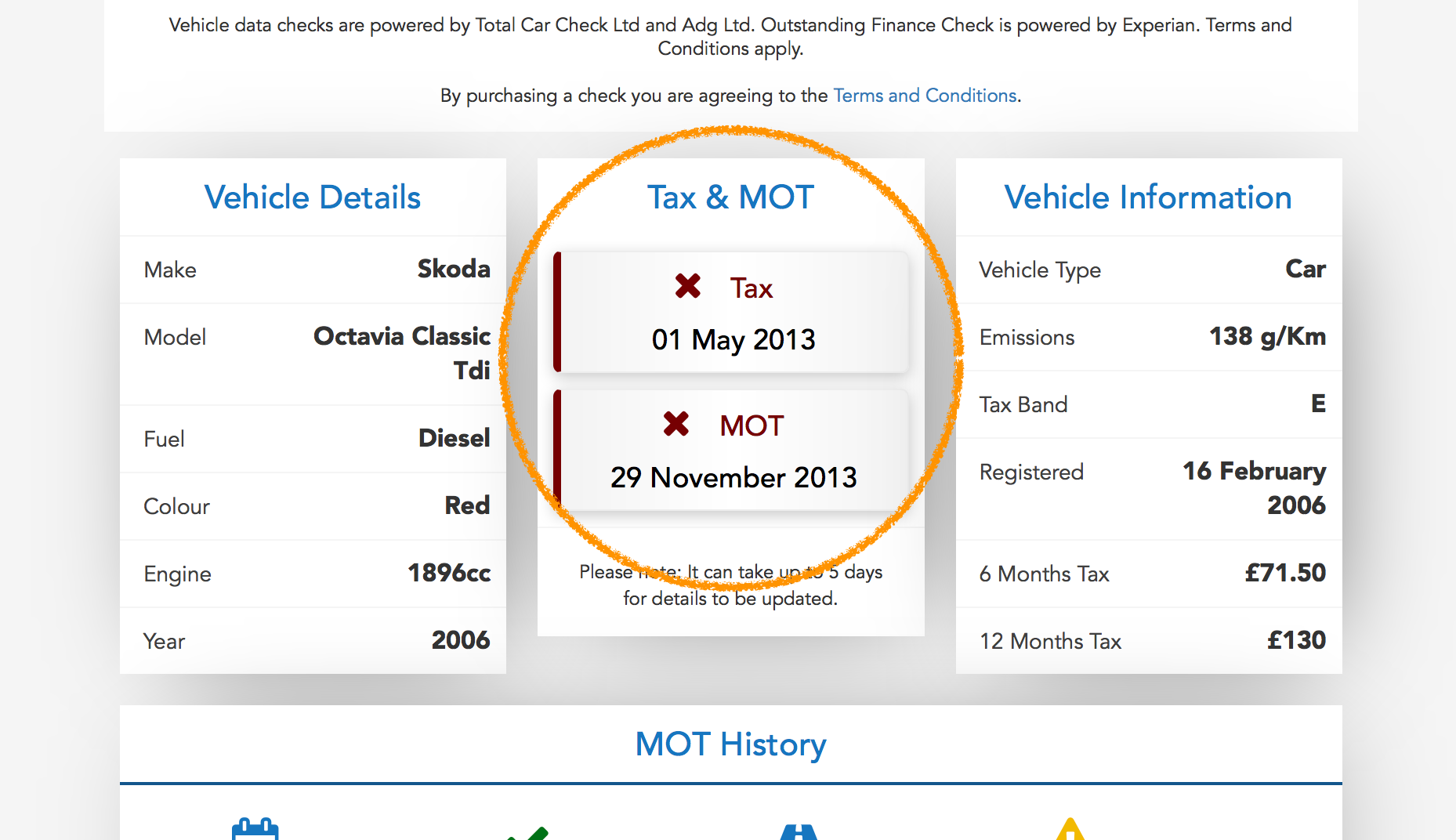

A recent reminder v11 or last chance warning letter from dvla your vehicle log book v5c it must be in your name the green new keepers details slip v5c2 from a log book if youve just bought it you can pay by debit or credit card. Youll need to bring these to any post office branch that deals with vehicle tax. Find out if a vehicle has up to date vehicle tax or has been registered as off the road sorn. The documents you need to tax a car vary depending on whether the car is brand new or not.

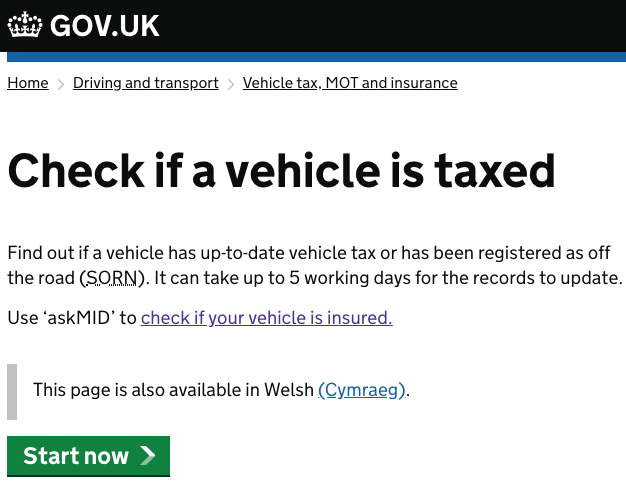

You have the option of paying via direct debit. Check if a vehicle is taxed. Renew your car tax online. Life is busy enough without wasting hours of precious time standing in a post office queue every six or 12 months to renew your road tax.

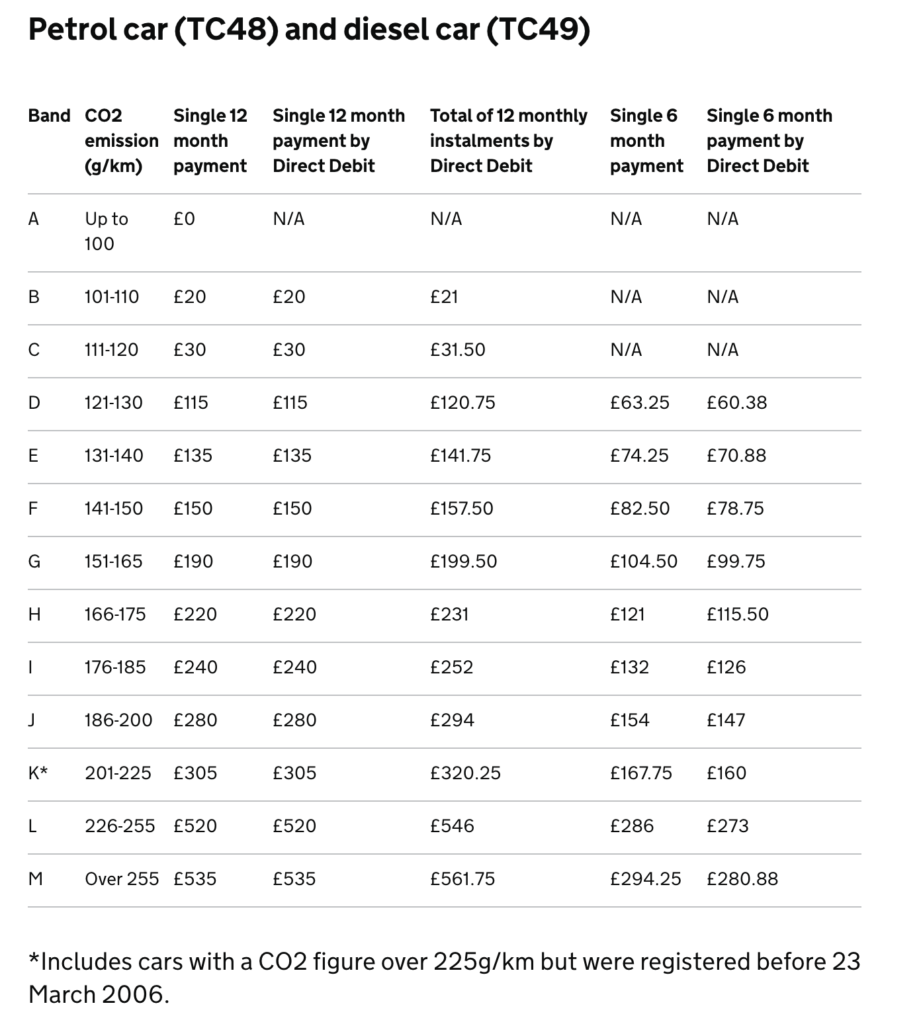

The online car tax guide car tax or road tax also known as vehicle excise duty ved needs to be paid for every car registered in the uk. Use askmid to check if your vehicle is insured. You dont need to tax and insure your car if youve declared it off the road and made a sorn statutory off road notification. You can tax your car without having the insurance document to hand.

It must kept in a garage or on private land. These have been abolished and police use automatic number plate recognition to search the tax database and check you have your tax in place. It can take up to 5 working days for the records to update. To be able to make a sorn you cant keep your car on a public road.

How to tax a car. There are many things to consider when selling a used car. Income tax liability when selling your used car. As before you can pay for your car tax in one lump sum either by cash cheque debit or credit card.

Find a local branch that can sort out vehicle tax with our branch finder. To tax the car you need the new keeper section of the v5c online another reason to insist on seeing the v5c before you buy the car and you can tax the car immediately either online via govuk over the phone 24 hours a day or at a post office that deals with vehicle tax. In a nutshell the internal revenue service irs views all personal vehicles as capital assets.