Hmrc Tax Tables

You can then paste the contents of the pop up box a web link into another application eg.

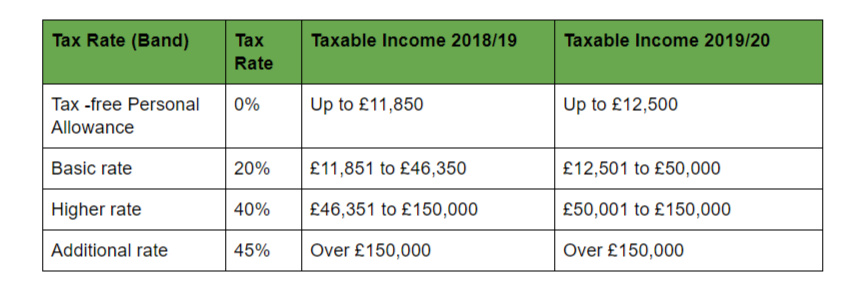

Hmrc tax tables. If youre an employer exempt from filing online use these tables to calculate your payroll manually. The system will store the details of the saved table view so that when you click on the saved web link you will see the table view you selected to save. If you take the new basic tax rate threshold of 37500 and add it it the new basic personal allowance of 12500 we see that for 201920 you can earn 50000 before you cross into the 40 tax rate. 6 april 2018 rates allowances and duties have been updated for the tax year 2018 to 2019.

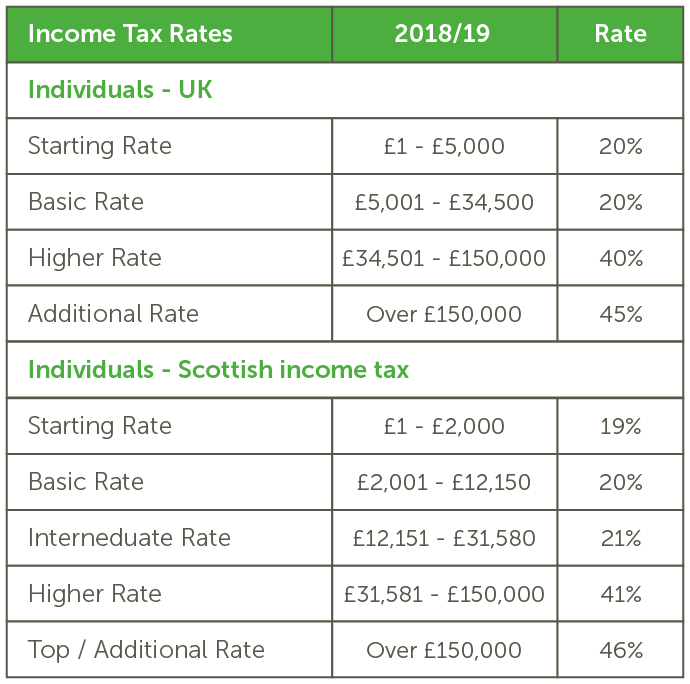

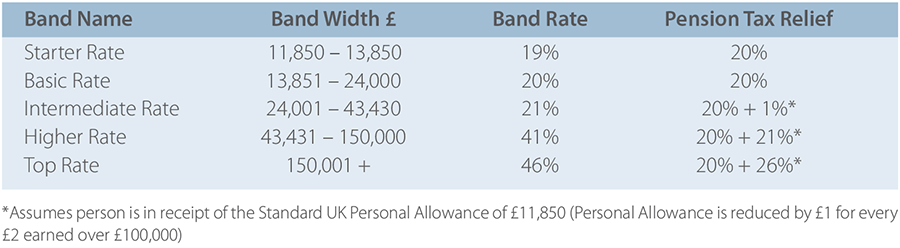

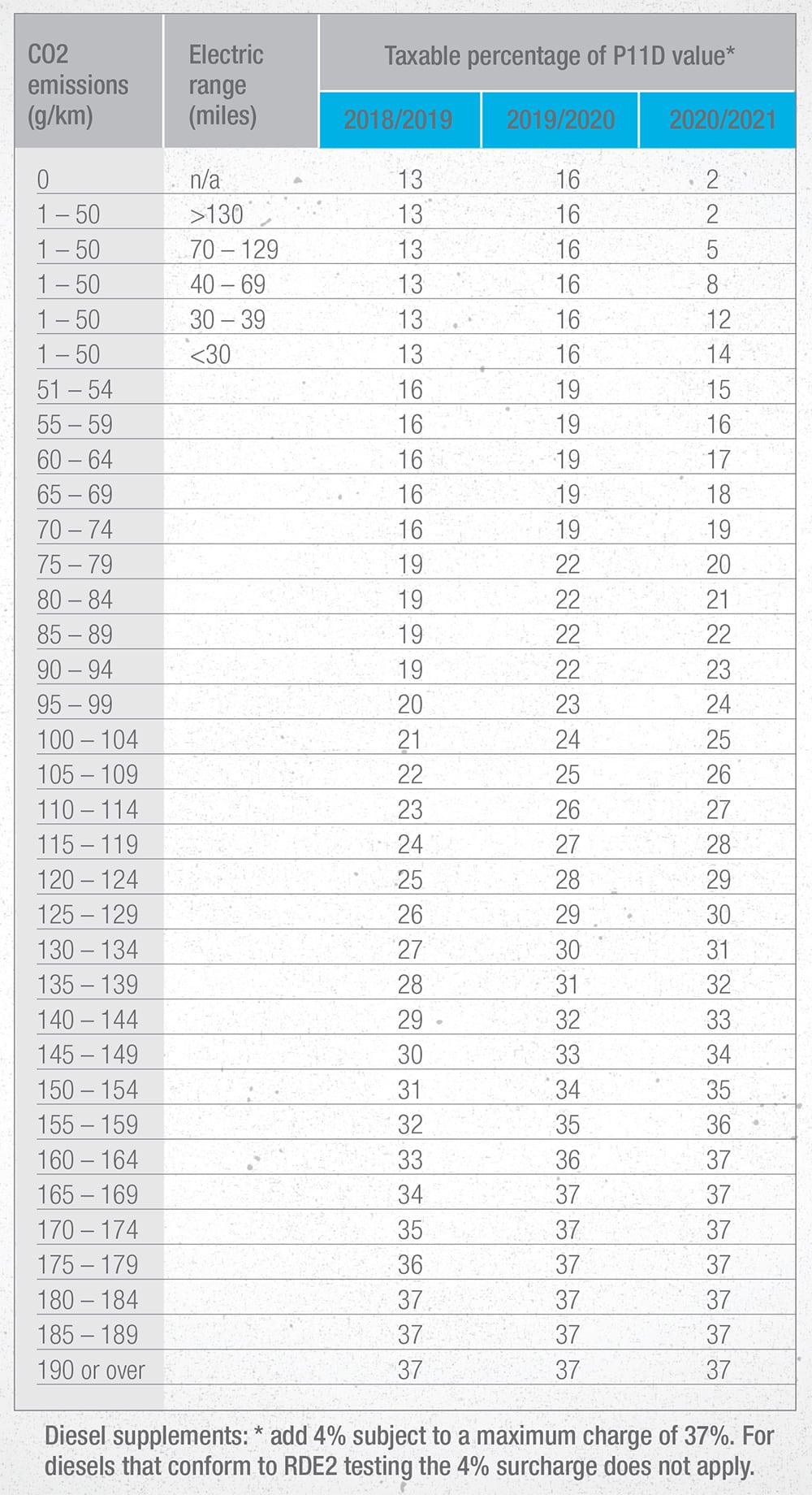

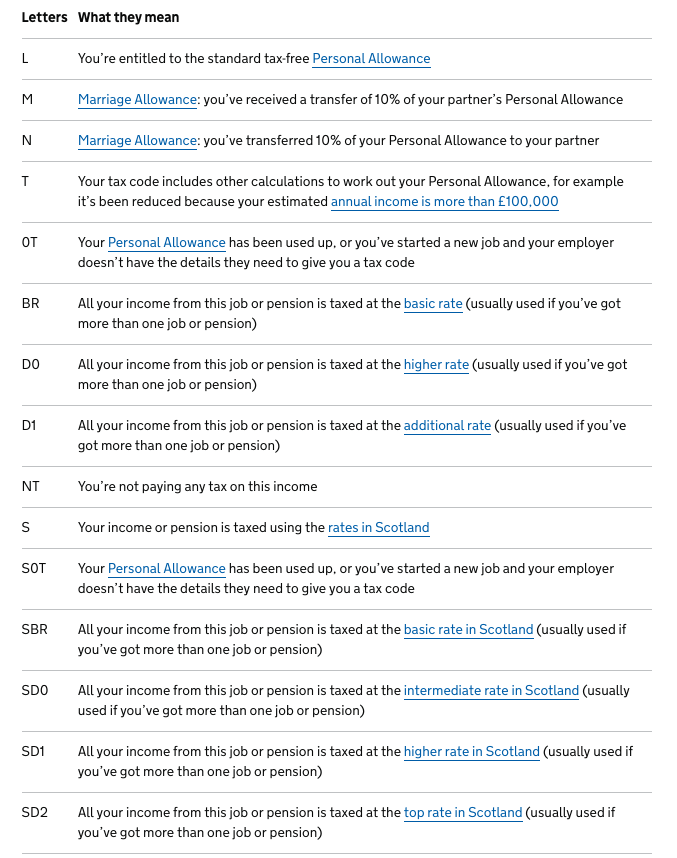

Bik rates and company car tax. Uk paye tax rates and allowances 201819 we have published a quick reference to the significant changes to the tax rates and bands personal tax allowances and national insurance figures which come into effect from april 6th 2018. For code d0 always multiply the whole pay by 040 40 to find the tax deduction at the higher rate. Essential tax tables 201819.

The widening of the basic rate tax bracket and the increase in the basic personal allowance means you can earn more this coming tax year before crossing into the 40 tax bracket. If you use these tables please make sure that you have disposed of your previous tax tables. A word document an email save as a web favourite or even share on a social networking site. Scottish rates and bands for 2018 to 2019 on the 20 february 2018 the scottish parliament set the following income tax rates and bands for 2018 to 2019.

If you would like access to the tax tables. How to use a tax code for code br always multiply the whole pay by 020 20 to find the tax deduction at the basic rate. And the taxable percentage in the right hand side columns for each tax year. 26 april 2017 rates allowances and duties have been updated for the tax year 2017 to 2018.

The company car tax table shows the co2 emission bands on the left hand side columns. The benefit in kind tax percentages will be applied to the p11d value of your company car for each taxation year.