Evoque Insurance Cost

Progressive offers the most affordable car insurance prices for the land rover range rover evoque with a mean annual premium of 494 48 cheaper than the average among top insurance companies.

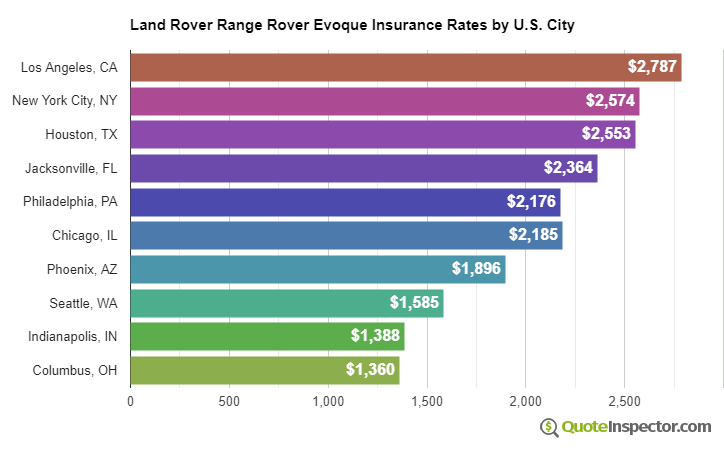

Evoque insurance cost. Step 1 find the coverage you need. Your actual cost could be more or less depending on your driving record the number of miles you drive in a year and other factors. The right car insurance for you depends on the coverage you need and the monthly premium and deductible that best suit your budget. Average land rover range rover evoque insurance rates the average insurance costs for a land rover range rover evoque is 220 a month or 2640 a year.

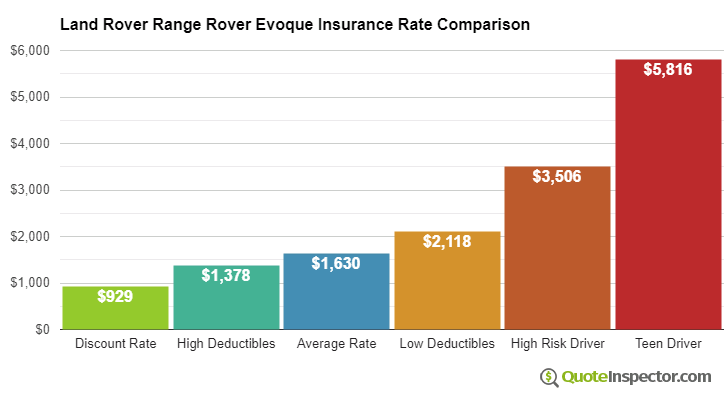

Buying a liability only policy costs as little as 486 a year and high risk insurance costs around 3342. The used 2016 land rover range rover evoque true cost to own includes depreciation taxes financing fuel costs insurance maintenance repairs and tax credits over the span of 5 years of. Usually all that is needed to get started is a few basic details and information about the car and the drivers credentials. How much does land rover range rover evoque car insurance cost.

Finding insurance via a comparison service might mean finding a range rover evoque insurance policy that tailors to the owners exact need. Average insurance rates for a 2015 land rover range rover evoque are 1544 a year for full coverage. Suggested limits of liability. Your insurance should be too.

A deductible of 500 or more is usually carried on this to reduce insurance rates. The most expensive auto insurance carrier for the land rover range rover evoque is metlife with an average outlay of 2912 annually. For a benchmark the previous evoque costs 330 for an interim service and 440 for a full service at a land rover dealership so this is something to bear in mind if you are looking to buy one. For a 40 year old driver insurance rates for a land rover range rover evoque range from the low end price of 460 for minimum levels of liability insurance to a much higher rate of 3418 for high risk insurance.

Again a deductible of 500 or more is usually carried to reduce premiums.