Company Van Tax Rules 2018

Business vehicle trade ins under the new tax law by stephen fishman on january 24 2018 in taxes.

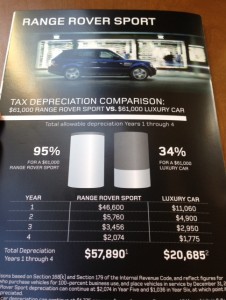

Company van tax rules 2018. And vans are treated for tax. 280fd7 is 18000 for the first tax year including bonus depreciation or 10000 if bonus depreciation does not apply. The benefit in kind charge for vans is currently set at a fixed rate of 3350 for the 201819 tax year this means that any van or pickup that falls under personal use will we subject to a payment of 670 for a 20 taxpayer and 1340 for a 40 taxpayer. For passenger automobiles including trucks or vans under 6000 gvw placed in service during the calendar year 2018 the depreciation limit adjustment under sec.

The van benefit and car and van fuel benefit order 2016 si 20161174 set the van benefit charge at 3230 for 2017 to 2018 the car fuel benefit multiplier at 22600 and the van fuel benefit at 610. Tax and reporting rules for employers providing company vans and fuel. You will include the fair market value of the employees personal use of the company vehicle in their wages. For 201819 tax year the company van tax benefit in kind is 3350 a rise of 120 from last year.

The new tax law has revamped rules for people who use their cars for their small businesses. The 20182019 van fuel benefit charge rate is 633 a year but thats the benefit value so youll be taxed on 20 or 40 of that figure rather than be forced to pay the whole amount. Apply the rules on a vehicle by vehicle basis. Put to business use in 2018 the maximum allowances are.

The tax cuts and jobs act tcja has resulted in many changes in the tax laws. If you use a work van for private journeys and your employer pays for the fuel youre also subject to tax on that benefit. If you pay tax at the higher 40 rate then the tax figure is 1340. If you pay tax at 20 then the figure is 670 a year.

:brightness(10):contrast(5):no_upscale()/young-couple-watching-movers-move-boxes-from-the-moving-van-186481665-5c19a40fc9e77c0001ee0f75.jpg)