Company Van Benefit 2016 17

The fuel benefit is reduced to nil only if the employee pays for all private fuel.

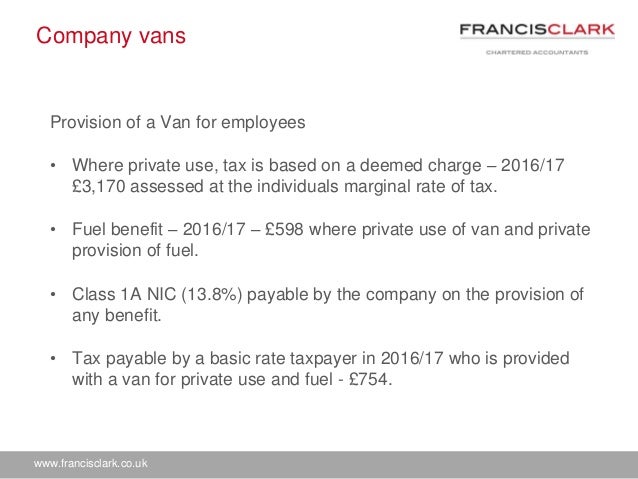

Company van benefit 2016 17. For 2016 17 and 2017 18 the van benefit charge for zero emission vans will be equal to 20 of the benefit charge for vans that emit co2. The 20 tapered rate van benefit charge for zero emissions vans will remain for 201617 and 201718. The taxable benefit for the unrestricted use of company vans is 3170 plus a further 598 of taxable benefit if fuel is provided by the employer for private travel. So a 20 income tax payer will be charged 20 of 633 for free fuel which is 127 a year.

54965 but it will receive tax relief on that amount depending on the rate of tax it pays as a company or business. The charges do not apply to vans if a restricted private use condition is met throughout the year. If the employer provides any fuel used for private journeys and is not reimbursed for the cost the 201617 tax bill for the fuel is. From 2008 09 there is a starting rate for savings income only.

The van benefit charge exemption for zero emission vans is to be phased out. Van benefit charge for 201819. The charges do not apply to vans if a restricted private use condition is met throughout the year. The government confirmed in last months autumn budget statement that inflation linked increases to existing charges would be introduced.

A 40 tax payer will pay 253 a year. Question i run my own limited company and i bought a company van on 1st december 2016 which i use for both personal and business use. See company car tax tables for more information on this. The annual benefit in kind tax liability for company vans is a fixed rate unlike cars where the tax is based on a scale of co2 emissions and the list price of the car.

I believe i will have some benefit in kind tax that i need to pay but i am not sure how to calculate this or how i am meant read more. Tax and tax credit rates and thresholds for 2016 17 published 25 november 2015. A fuel benefit may also be chargeable if an employee has the benefit of private fuel paid for in respect of a company van. This defers by one year to 2018 19 the planned increase to 40 of the van benefit charge for conventionally fuelled vans.

The van benefit charge the commercial vehicle equivalent of company car tax has also increased from april 6 2018. A reduced charge may be due if the van cannot in any circumstances emit co 2 by. Van benefits van benefits. Government confirms 201819 car and van fuel benefit and van benefit charges.

Van benefit per vehicle 201617. The government has confirmed the car and van fuel benefit and van benefit charges that will apply from 6th april 2018. Van benefit is chargeable if the van is available for an employees private use.