Company Taxation Uk

As from 6 april 2018 itll probably become more expensive.

Company taxation uk. Detailed description of taxes on corporate income in united kingdom. The uk corporate tax regime applies to incorporated companies limited by shares or guarantee and other bodies including clubs and associations. Uk dividend tax rates are as follows. Payments are in instalments divided into 4 quarterly payments 12 month accounting period.

United kingdom source income is generally subject to uk taxation whatever the citizenship and place of residence of an individual or the place of registration of a company. You are not required to pay uk dividend tax on the first 2000 of dividends you receive in the tax year. Registering your business as a limited company can reduce your tax liability and save you money. There are different corporation tax rates for companies that make profits from oil extraction or oil rights in the uk or uk continental shelf.

But getting paid through a limited company is slightly more complicated than being a sole trader. What are the due dates for ltd. Heres a look at how company car tax rates have changed in 201819 and what this means for your tax bill. Uk limited company with tax profits up to gbp15 million.

If you own shares in a uk company you may get a dividend tax payment. Who pays company car tax. This means that the uk income tax liability of an individual who is neither resident nor ordinarily resident in the united kingdom is limited to any tax deducted at source. Help us improve govuk.

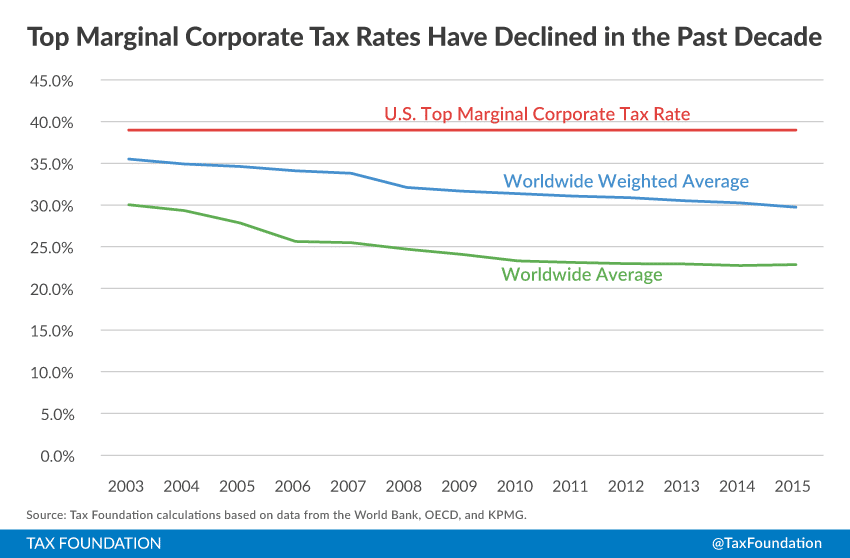

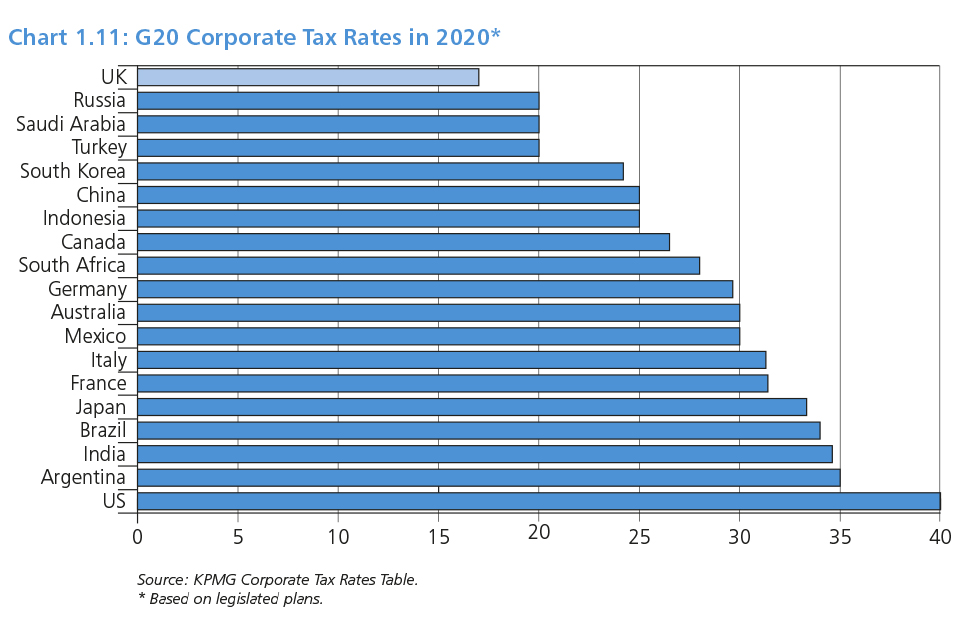

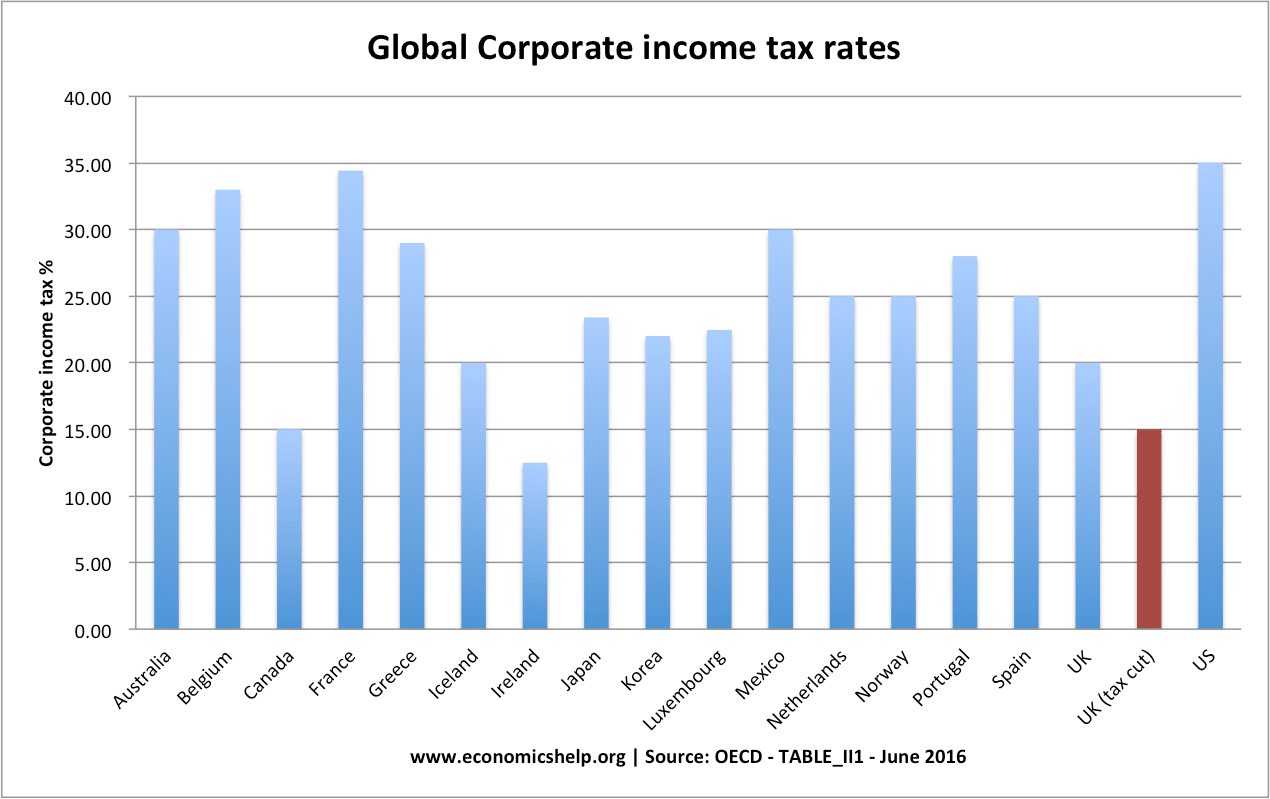

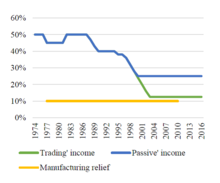

Uk limited company with taxable profits exceeding gbp15 million. These are known as ring fence companies. The corporation tax rate for company profits is 19. Dont be confused by bik company car tax rates our guide explains all and shows you how to calculate them company cars have long been used by businesses to reward and retain staff as an extra.

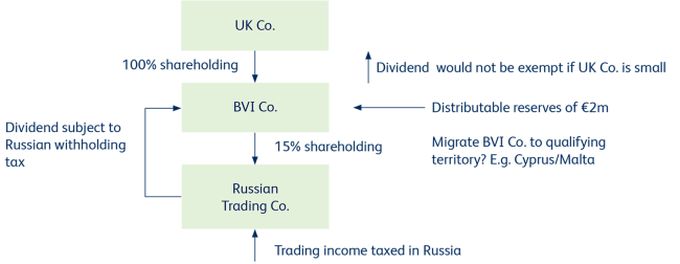

Resident companies are taxable in the united kingdom on their worldwide profits subject to an opt out for non uk permanent establishments pes while non resident companies are subject to uk corporation tax on the trading profits attributable to a uk pe or the trading profits attributable to a trade of dealing in or. How much tax does a limited company pay in the uk. What you need to know. Drive a company car.

Working out your corporation tax rate and getting reliefs and other deductions from your corporation tax bill. The uk corporation tax regime does not apply to trusts partnerships or individuals.