Company Car Tax Rules

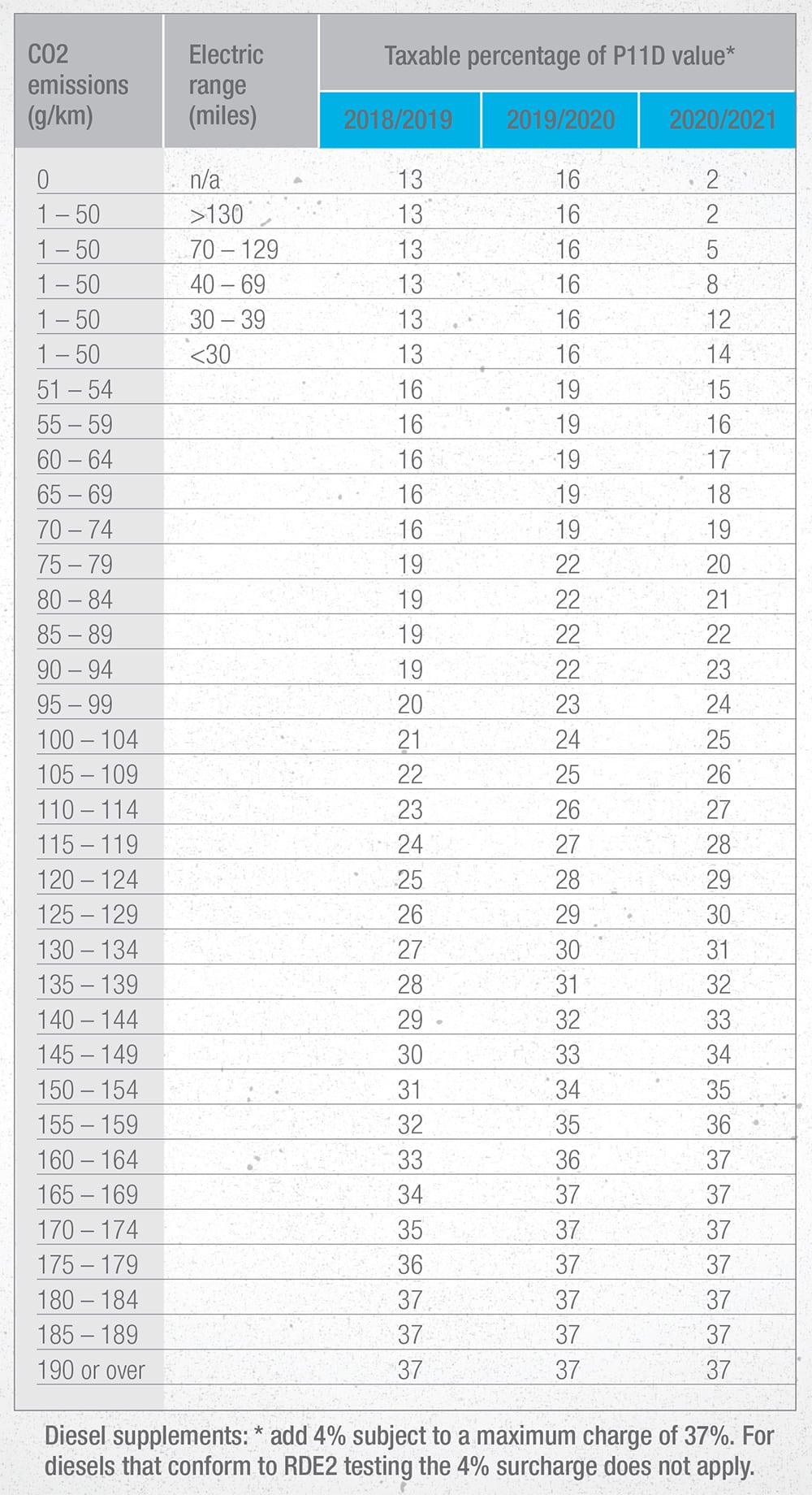

Curiously the government plans to hike up bik tax for electric cars and hybrids in 201920.

Company car tax rules. Use by a spouse or dependent. Tax rules for company cars a fringe benefit. You may use this rate to reimburse an employee for business use of a personal vehicle and under certain conditions you may use the rate under the cents per mile rule to value the personal use of a vehicle you provide to an employee. In most cases time spent using your company car for personal use is considered a taxable fringe benefit.

Company car tax was reformed in april 2002 to an emissions based system. The fuel type of the car and its co2 emissions determine the appropriate percentage. The business mileage rate for 2019 is 58 cents per mile. Personal use of a company vehicle is a taxable noncash fringe benefit.

Business vehicle deduction considerations not all vehicles qualify for the business vehicle deduction. Topic number 510 business use of car. But itll slash it to two percent as from 202021. Vacation or weekend use.

See cents per mile rule in section 3. This means that in 202021 company car tax on electric cars and hybrids will be significantly cheaper than a tax on company cars with other engine types. The amount of company car tax you pay depends on the value of the car its co2 emissions your personal tax rate and whether you forgo cash for the car either under a salary sacrifice scheme or as a cash allowance. Personal use of company vehicle defined.

According to the irs personal use of a company vehicle is a noncash fringe. Personal use of a company car pucc includes. Company car tax can be a daunting subject but there are benefit in kind calculators on specialist websites that can help you calculate your tax outgoings on a company car. One approach set out by the irs for handling the taxability of a company car as.

Commuting to and from work. Running a personal errand. Read more about changes to cash allowance and car salary sacrifice scheme rules above. Here are some things you need to know about the business vehicle deduction as far as the government is concerned.

Include gas oil repairs tires insurance registration fees licenses and depreciation or lease payments attributable to the portion of the total miles driven that are business miles. The internal revenue service counts fringe benefits goods services and experiences given to employees in addition to standard wages as a form of taxable income. The charge is calculated by applying a percentage figure the appropriate percentage to the list price of the car. For example vehicles that are used as equipment such as a dump truck have different rules than other vehicles.