Company Car Tax 2017 18

Use the company car tax calculator to view the bik rates and tax payable for a specific make or model during the period 2018 2021.

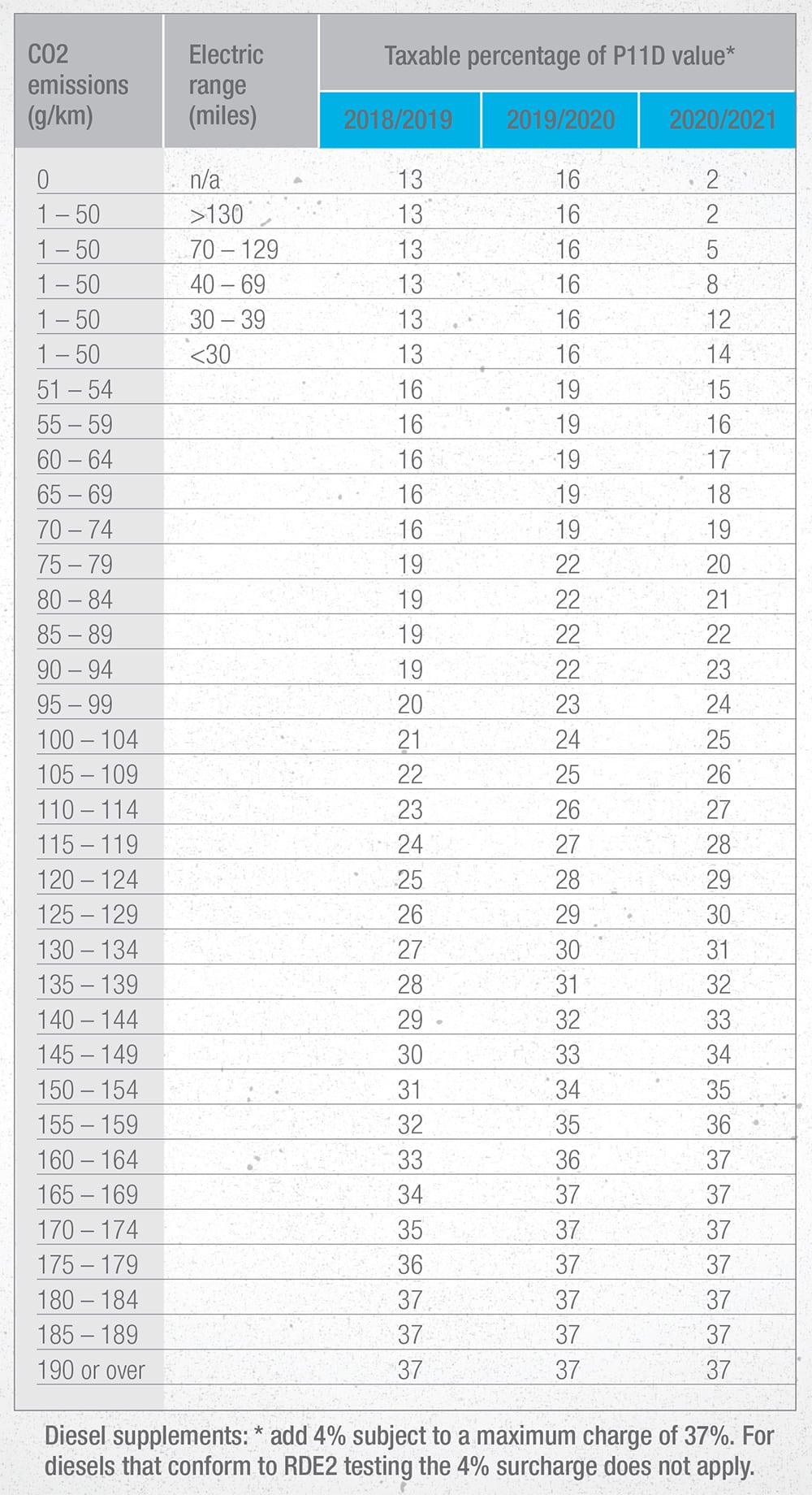

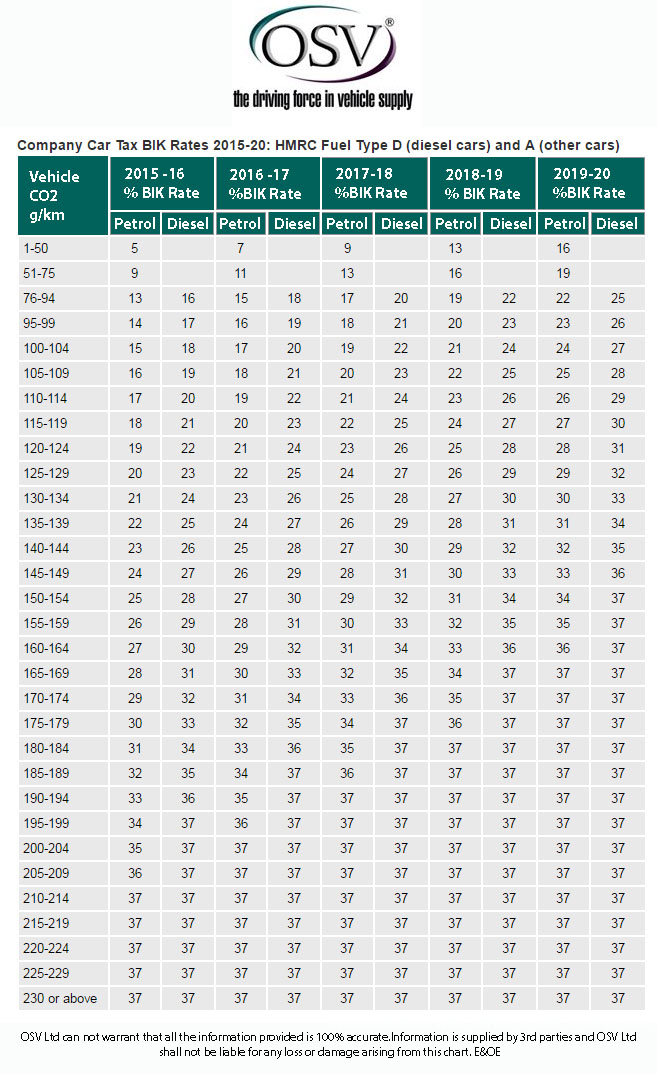

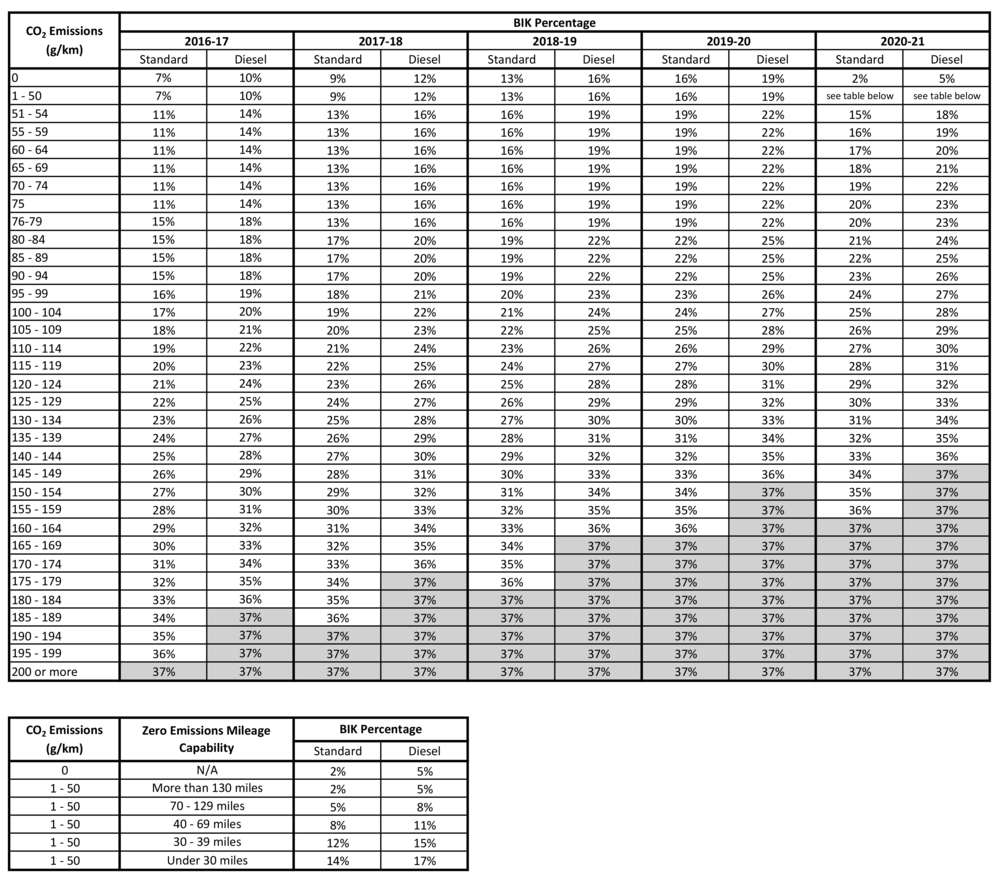

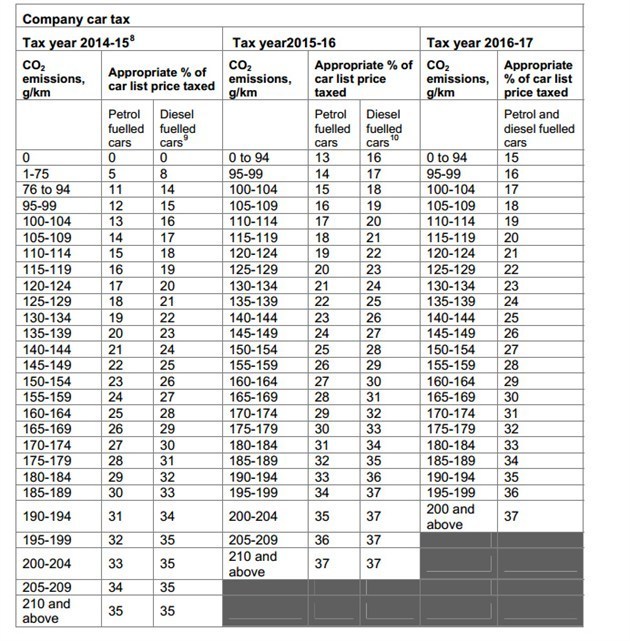

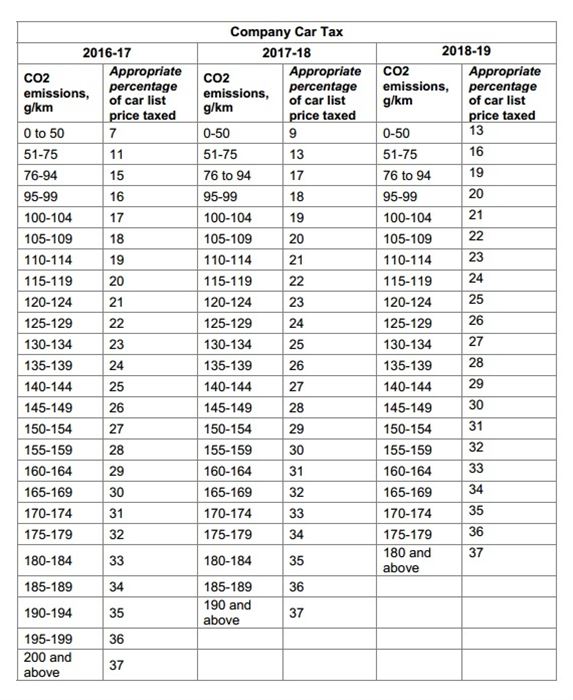

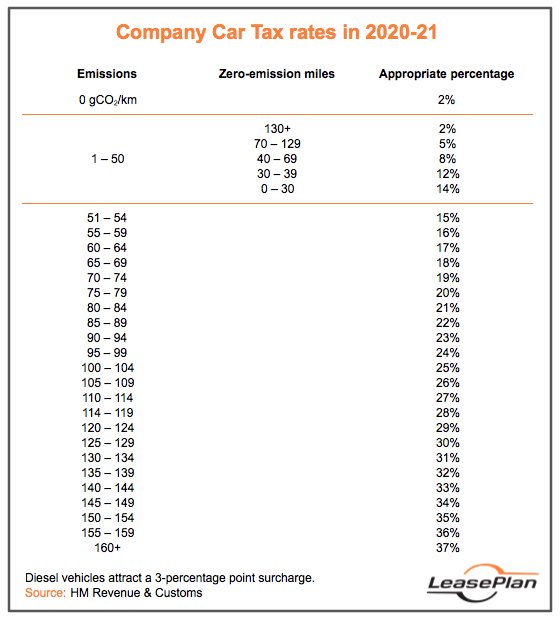

Company car tax 2017 18. Youll pay tax if you or your family use a company car privately including for commuting. Company car bik tax rates 2017 2020 201718 201819 201920 gkm co 2 petrol diesel petrol diesel petrol diesel 0 50 9 12 13 16 16 19 51 75 13 16 16 19 19 22 76 94 17 20 19 22 22 25 95 99 18 21 20 23 23 26 100 104 19 22 21 24 24 27 105 109 20 23 22 25 25 28 110 114 21 24 23 26 26 29. All tax rates shown reflect changes announced in budget 2017. Select the used button if your car is not currently available to purchase as a new model.

You will pay tax on the result at your marginal rate 20 or 40 in 201718. There is a 3 supplement for diesel powered cars in years up to and including 2017 18. Need helping working out your company car tax. The charge is calculated by applying a percentage figure the appropriate percentage to the list price of the car.

35 petrol gas and conversions. Calculate tax on employees company cars as an employer if you provide company cars or fuel for your employees private use youll need to work out the taxable value so you can report this. This is normally deducted every month from your salary. Company car tax calculator.

If youre struggling to decide which company car to go. You need to apply the following company car tax table which is based on engine size 0 1400cc. 15 petrol gas and conversions. Cc 0 litre.

28 diesel over 2000cc. To promote ultra low emission vehicles ulevs they benefit from reduced rates of company car tax. Electric vehicles attract a rate of 7 in the 2016 2017 tax year rising to 9 from april 2017. Diesel cars and your tax bill diesel engines produce less co 2 than petrol engines so your actual company car tax bill should be smaller than it would be from an equivalent petrol model.

The parkers company car tax calculator helps you work out how much benefit in kind tax you would have to pay for your new company car broken down into annual and monthly costs for 20 40 or 45 percent tax payers. 25 petrol gas and conversions. You pay tax on the value to you of the company car which depends on things like how much it would cost. Company car tax calculator.