British Tax System Explained

Electric cars are exempt from certain uk car taxes based on their low emission output.

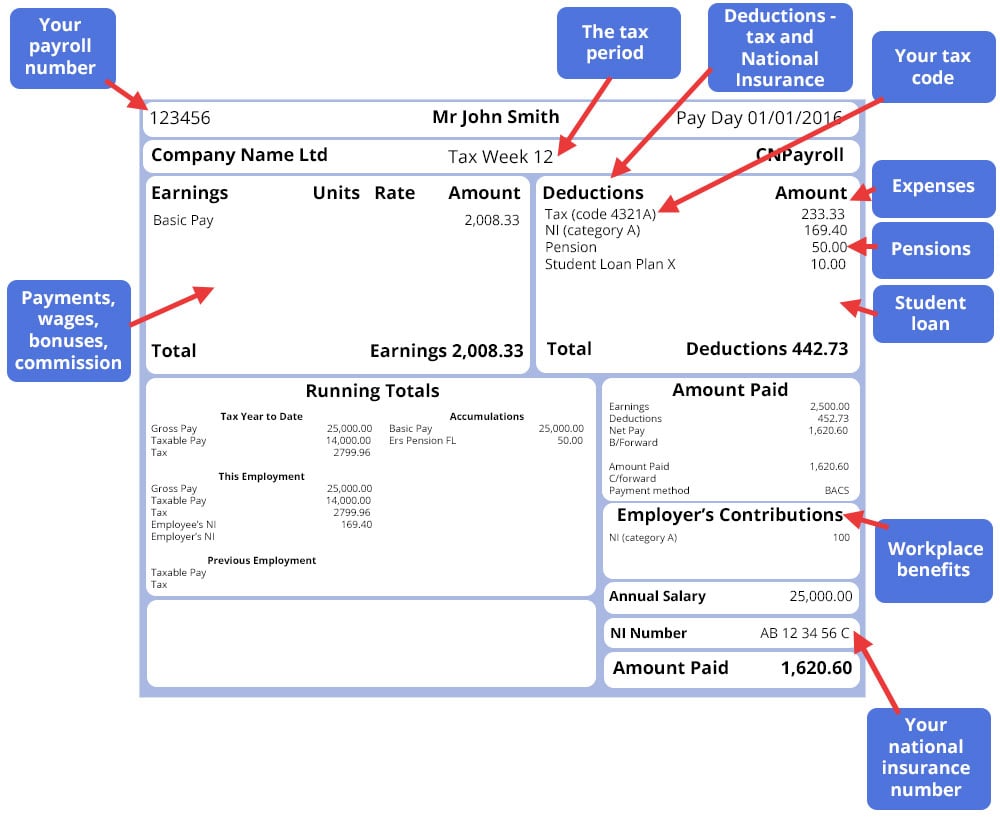

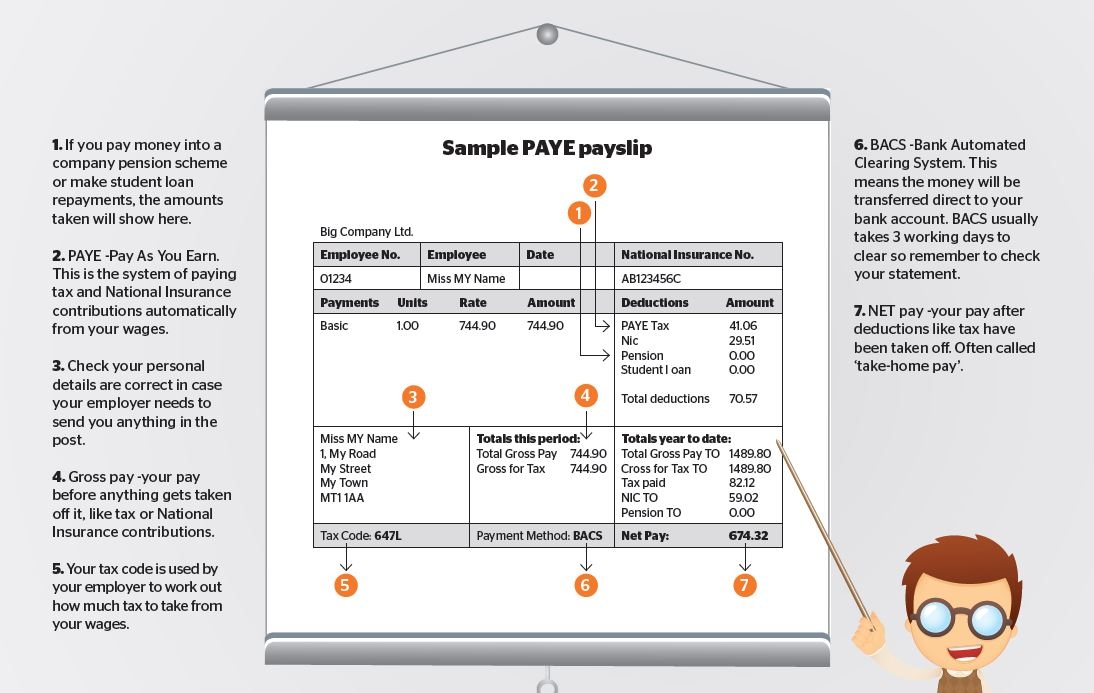

British tax system explained. Further information on tax codes taxable. You have a right to obtain your weeklyfortnightlymonthly payslips from your employer where all your taxable earnings should appear as well as any bonuses and overtime with relative income and national insurance deductions. Corporation tax is a tax levied in the united kingdom on the profits made by companies and on the profits of permanent establishments of non uk resident companies and associations that trade in the eu. Then international legal research company lexisnexis revealed their finding that the uk tax code has more than doubled in size since 1997 reaching 11520 pages.

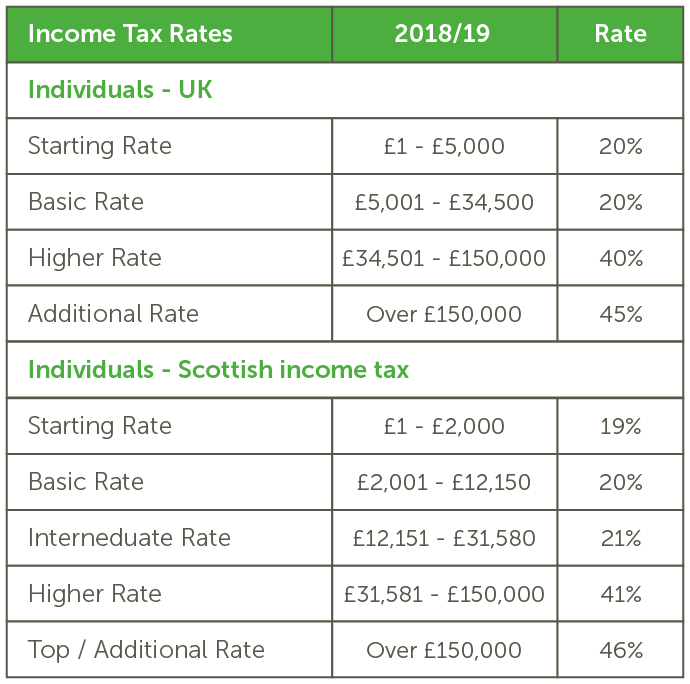

The annual changes to. Independent pov 22552 views. For individuals a tax year which is also known as a fiscal year or year of assessment runs from 6 april to the following 5 april inclusive. Income tax is a percentage of wages earned that goes to the government to pay for things such as the national health service the armed forces the police force public services roads and infrastructure.

The changes to the tax system that are proposed in the annual budget speech in march are generally intended to take effect as from the start of the next tax year. Corporation tax forms the fourth largest source of government revenue after income nic and vat. Arguably uk has the longest tax code in the world since 2009. Uk tax can be confusing.

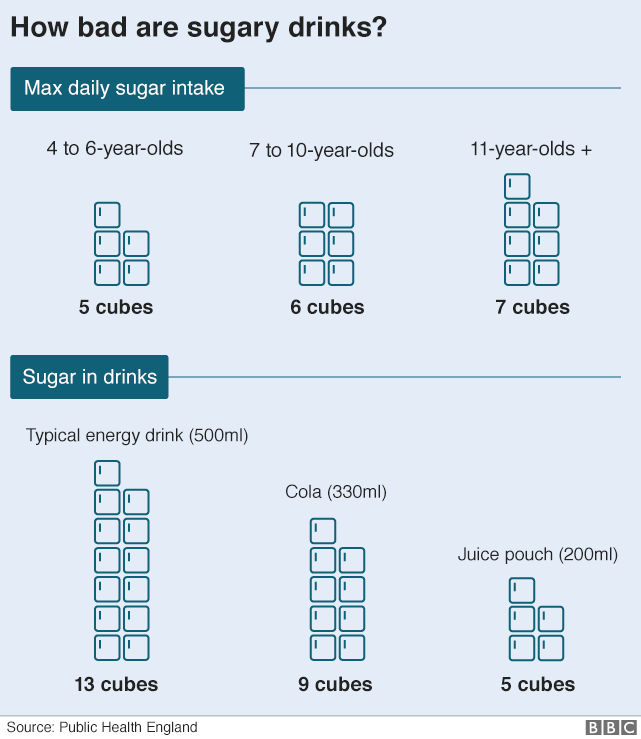

Tax is levied on many goods and services in the shape of value added tax vat. Individuals who are self employed must register with the hmrc. Read more on uk road rules. Nicholas shaxson on tax havens the banking system uk uncut duration.

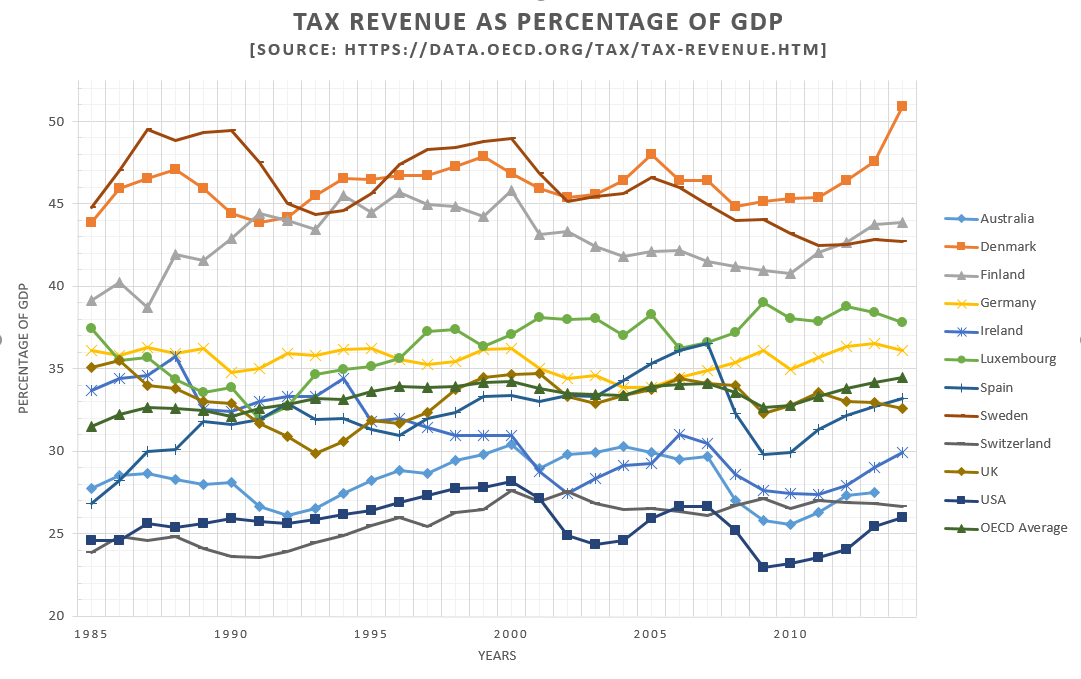

Tax is how the government raises money to spend on public services such as education health and the social security system. We pay income tax on the money we earn. Tax can also be levied on a range of transactions. Uk tax system consulting with business on the direction and design of our reforms.

We believe that the corporate tax system can and should be an asset for the 2019. This short video gives a visual explanation of how tax and tax codes work and uses some examples to show you how you pay tax. We have made tax policy simpler more transparent and therefore better suited to a globalised trading world and to modern business practice. The tax system explained.

The tax system in the united kingdom is not easy to explain to foreigners. The tax year in the uk begins on the 6th april each year and ends on the 5th april of the next year. The british use the metric system kmh.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9498929/Corporate_tax_rate_graphic.PNG)